- Every one of these growth stocks has a shot at becoming large-cap stocks.

- Crocs (CROX): The company’s Hey Dude acquisition will help maintain double-digit growth for several more years.

- Columbia Banking System (COLB): It’s about to get a whole lot bigger.

- Centennial Resource Development (CDEV): Some feel it didn’t play hardball in its merger of equals.

- Safehold (SAFE): The company is singlehandedly building up the ground lease industry.

- Sensus Healthcare (SRTS): Its non-invasive treatment for lesions could also be good for animals.

- Gambling.com (GAMB): It continues to make money from affiliate marketing for the sports betting and iGaming industry.

- Sachem Capital (SACH): The house flipping industry remains this REITs bread and butter.

Canada’s national business paper, The Globe and Mail, recently interviewed a Toronto-based portfolio manager who seeks out smaller growth stocks with the potential to become large caps over the long haul. Alex Etsell invests $2.3 billion for Hillsdale Investment Management in microcap and small-cap strategies for the firm’s clients. He defines microcaps as stocks with market capitalizations between $100 million and $300 million, while small-caps are those between $300 million and $4 billion.

In Etsell’s case, he’s investing in Toronto Stock Exchange and TSX Venture Exchange stocks, but his philosophy can be applied to U.S. stocks.

“We’re always looking to hold high-quality names, which in this market environment are companies that are growing and still showing profitability and have very strong margins. These factors are especially important in a high-inflation environment,” Etsell told The Globe and Mail on Jul. 23.

Therefore, I have selected four small-cap stocks and three microcaps for this article using Estell’s size definitions. These businesses are projected to grow revenues by at least 30% annually over the next two years and are profitable with 10% net margins.

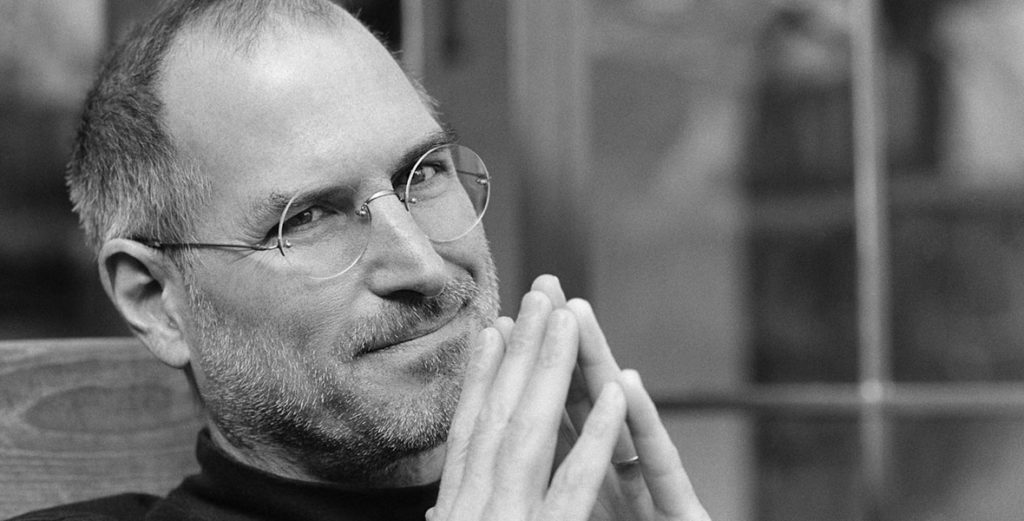

One last tech marvel from Steve Jobs?

Before Steve Jobs died…

He actually left behind one more radical idea for Apple.

An idea so big and so novel, it could completely change the way we see Apple as a company forever.

For over 7 months, my team and I have been piecing together the breadcrumbs… clues left in plain sight…

And our research indicates that this last technological marvel from the mind of Steve Jobs…

Could be 10X bigger than the iPad… the MacBook… and the iPhone… COMBINED.

In fact, it stands at the center of an emerging industry Bloomberg forecasts will grow as much as 19,254% in the coming years!

Early investors could make a fortune if they know where to position themselves…

And I've discovered a potential backdoor Apple play my research shows could 40X your money once this device goes live…

The best part is all you need is $5 to position yourself TODAY!

Growth Stocks: Crocs (CROX)

Source: Wannee_photographer / Shutterstock.com

I was recently out at the ocean with friends. One of them was wearing a pair of Crocs (NASDAQ:CROX). It reminded me that the foam clog manufacturer was still alive and kicking. As its website reminds visitors, it has sold more than 720 million pairs since its inception in 2002.

In May, Crocs reported 47% revenue growth (excluding currency) to $660.1 million. As a result, the company raised its full-year revenue growth outlook to $3.5 billion, 53.5% higher than a year earlier at the midpoint of its guidance. It is profitable with an expected adjusted operating margin of 26% to 27%.

Now, a big chunk of its growth is from its $2.5 billion acquisition of Hey Dude, a sustainable shoe brand from Italy that is popular with teenagers. But even without Hey Dude, the Crocs brand will grow more than 20% in 2022.

Yet, CROX stock has fallen by more than 53% year-to-date through Jul. 25. As a result, you can now buy its stock for 9.9x it’s trailing 12-month free cash flow (or FCF) of $380 million. I consider anything 8% or higher to be in value territory.

By virtually every financial metric, CROX is cheaper than it has been since 2017.

Columbia Banking System (COLB)

Source: Tada Images / Shutterstock

If you’ve been a long-time shareholder of the Tacoma, Washington bank holding company, Columbia Banking System’s (NASDAQ:COLB) returns have not been excellent. Over the past five years, it has had a cumulative return of negative 23%. The S&P 500 over the same period gained more than 60%.

As I said, COLB is the holding company for Columbia Bank, a Washington state-chartered full-service commercial bank. It provides commercial banking services from 152 branches in Washington, Oregon, Idaho, and California.

Since its founding in 1993, Columbia Bank’s made 14 acquisitions, growing its assets, deposits, and loans to $20.6 billion, $18 billion, and $11.3 billion, respectively.

In the second quarter (Q2) of 2022, COLB had a net interest income of $147.45 million, 17.5% higher than a year earlier. Its net interest margin (NIM) in Q2 2022 was 3.16%. For comparison, my favorite U.S. bank is SVB Financial (NASDAQ:SIVB). Its NIM in the second quarter was 2.24%, 92 basis points less.

I don’t think there is any question Columbia Bank is well run. However, it will soon be part of a much bigger organization. In January, Columbia’s shareholders approved its deal to merge with Portland-based Umpqua Holdings (NASDAQ:UMPQ). The all-stock merger will see Columbia Banking System Chief Executive Officer (CEO) Clint Stein run the holding company, but Umpqua Bank will be the main brand and Umpqua shareholders will own 62% of COLB. Once the merger is completed, Umpqua Bank will have the second-largest deposit base on the West Coast behind only U.S. Bancorp (NYSE:USB).

Growth Stocks: Centennial Resource Development (CDEV)

Source: bht2000 / Shutterstock.com

It has been months since Centennial Resource Development (NASDAQ:CDEV) announced its merger of equals with Colgate Energy Partners III. Together, the combined entity will be the largest pure-play exploration and production company operating in the Delaware Basin, with an approximate production of 135,000 barrels of oil equivalent per day and more than $1 billion in annual free cash flow.

The deal valued Colgate Energy at $3.9 billion, including the assumption of $1.4 billion in net debt. CDEV is paying $525 million in cash and issuing 269.3 million shares of its stock. CDEV shareholders will own 52% of the combined business — $7 billion enterprise value — while Colgate shareholders will own the rest.

Under the merger arrangement, current Colgate co-CEOs Will Hickey and James Walter will run the company with Centenniel CEO Sean Smith becoming Executive Chairman. They’ve yet to announce the new name post-merger. It’s expected to close by the end of this year. In addition, the combination will enable the merged entity to deliver for shareholders.

“Importantly, the combined company is expected to provide shareholders with an accelerated capital return program through a fixed dividend coupled with a share repurchase plan,” Smith stated in its May press release.

Based on a pro forma market cap of $5.6 billion ($7 billion enterprise value less $1.4 billion in net debt), its forward FCF of $1 billion or higher puts its FCF yield at 17.9%.

Some investors might believe Centennial didn’t drive a hard enough bargain for Colgate. Time will tell. On paper, it looks to me like an intelligent combination.

The #1 Fuel Stock Set to Surge – Less than $20

Gas prices are out of control right now.

That's why it's important you see this.

A new type of fueling station is sweeping the country… set to affect over 500,00 stations.

These new fuel stations can save drivers over $2,000 each year.

That's serious money.

But it's the investors in these new stocks that are really reaping the benefits.

Some of them have doubled investors' money in just a month's time… others have made investors gains of 10x-over 1,000%!

In this video…

You'll get details on the #1 fuel stock set to surge.

P.S. With a clear-cut solution to high gas prices, the stock detailed in this video has become the darling of Wall Street.

✓ Morgan Stanley is in for $37 million

✓ Citadel is in for $48 million

✓ BlackRock has put down $139 million

Grab something to write with and check it out.

Safehold (SAFE)

Source: wutzkohphoto / Shutterstock

A year ago, Safehold (NYSE:SAFE) was trading at around $95. As I write this, it’s down 57.2%. Now could be the perfect time to buy into the real estate investment trust that specializes in ground leases.

InvestorPlace contributor Bob Ciura recently recommended SAFE and its secure dividend. As Ciura stated, Safehold grew its earnings per share and revenue in Q1 2022 by more than 30%. Ciura estimates Safehold’s annualized net asset value per share will grow 6.8% over the next five years.

Safehold went public in June 2017, selling 10.25 million shares at $20. It began with 12 properties, including seven ground net leases (GNLs) and one master lease (five properties) worth $343 million. Today, its portfolio of GNLs is worth $5.5 billion, with 38% of them in the Northeast, another 26% in the West, and the rest spread across the remainder of the country.

Of the property types, approximately 48% of ground leases are for office buildings. Multifamily properties are the second-highest at 34%, with hotels and life sciences accounting for the rest. Approximately 94% of its GNLs are 60 years or greater, providing Safehold with stable long-term income.

The highlights of its first quarter include a 35% increase in earnings per share year-over-year (YOY), a 39% YOY increase in revenue, and $677 million invested in 10 new ground leases.

Safehold continues to take ground leases to the next level. It’s an exciting play for patient capital.

Growth Stocks: Sensus Healthcare (SRTS)

Source: metamorworks / Shutterstock

Sensus Healthcare (NASDAQ:SRTS) is the first of three micro-cap stocks to consider. The Florida-based medical device company provides non-invasive treatments of cancerous and non-cancerous skin conditions. The company’s superficial radiation therapy (or SRT) products have been used effectively on hundreds of thousands of patients in the U.S. and elsewhere.

In Q1 2022, the company’s revenue grew 237% to $10.3 million. Its revenue was from the shipment of 33 SRT-100 Vision systems. Excluding a $12.8 million gain from the sale of non-core assets, it earned $3.3 million during the quarter, up significantly from a $1.1 million loss in Q1 2021. As a result, it now expects to achieve full-year profitability. The company finished the first quarter with $32.8 million in cash and no debt on its balance sheet.

On Jul. 20, Sensus announced the expansion of its relationship with Colorado State University’s College of Veterinary Medicine and Biomedical Studies. The university acquired a second SRT-100 system. It will use the system to study horses and treat skin diseases. If successful, the company could start selling its systems to veterinary clinics — approximately 30,000 in the U.S. — across the country, providing Sensus with a second significant revenue stream. In Q1, it also launched its TransDermal Infusion technology, which could lead to the elimination of needle injections. It sold seven of these systems during Q1 2022.

While there is no question this is a risk-forward investment, the potential of its products most certainly exists.

Biden on video ordering secret military attack on Russia?

A former CIA and Pentagon adviser just released this new presentation…

…showing his explosive evidence of Biden…

…ordering direct US military intervention with Russia.

The consequences of this Biden blunder could soon be deadly for US citizens.

The evidence was caught right here on video, but I must warn you…

This Biden mistake could make you very angry.

>>Go here now to see the controversial video<<

Gambling.com (GAMB)

Source: 7th Sun / Shutterstock.com

Like many stocks in 2022 — large-cap or micro-cap — Gambling.com (NASDAQ:GAMB) is down significantly in 2022. As recently as February, it traded as high as $13.

Through affiliate marketing, the company makes money by bringing customers to sports betting and iGaming sites. Its sites include Gambling.com, bookies.com, Rotowire.com, and many others. Its clients include all the big gaming companies, including DraftKings (NASDAQ:DKNG) and Rush Street Interactive (NYSE:RSI).

The company’s history dates back to 2006, although the Gambling.com name was acquired for $2.5 million in April 2011. In 2019, it got a $15.5 million growth investment from Edison Partners. They continue to own almost 16% of the company.

Gambling.com has made a couple of big moves in 2022.

First, in January, it entered into a strategic partnership with McClatchy Newspapers. McClatchy will lean on the company’s gambling content from 35 different online portals, while Gambling.com gains access to McClatchy’s audience of more than 65 million unique visitors per month. It is the company’s first media partnership.

Secondly, in February, it acquired BonusFinder.com, an online portal that helps gamblers find the best bonuses for online sportsbooks and casinos. Its biggest market is Canada, although it’s making strides in the U.S. Gambling.com paid $14 million in cash and stock.

For all of 2022, Gambling.com expects revenue and adjusted earnings before interest, taxes, depreciation (EBITDA) of at least $71 million and $22 million, respectively.

Editor's Note: Crazy video of “peeing car” could spark $11.7 trillion in new wealth

“Peeing Car” At Center Of $11.7 Trillion Energy Revolution

Goldman Sachs says this will be 10X bigger than the electric vehicle market.

Elon Musk terrified. Tesla could be fInished. But early investors could make a fortune. >> DETAILS HERE

Growth Stocks: Sachem Capital (SACH)

Source: microstock3D / Shutterstock

Sachem Capital (NYSEAMERICAN:SACH) is a mortgage real estate investment trust based in Connecticut. Founded in 2009, it went public in 2017.

It provides short-term, high-yielding real estate loans to house flippers along the eastern seaboard from Maine to Florida. Sachem currently has a loan portfolio of $482 million spread across more than 515 loans. Since its inception in 2009, it has originated 1,750 loans totaling $710 million.

All of its loans have conservative loan-t0-value ratios and require personal guarantees from the principals of the borrowers. It closes on loans within as little as five days. The Small Business Administration (SBA) can take six months or more to complete.

The house flipping market remains an attractive one. According to Sachem’s June presentation, the average gross profit per transaction for home flippers in 2021 was $65,000. That’s up significantly from $36.75 a decade ago.

In recent years, Sachem has begun pursuing larger commercial loans into hotels, multi-family and more. In 2018, it had loans in six states. In 2021, it was up to 14, while the average loan increased from $196,000 to $562,000. Yet, the average term was only eight months compared to 11 previously.

On Jul. 11, the REIT increased its quarterly dividend by 16% to 14 cents from 12 cents. The July payment now pays an annualized dividend of 56 cents for a 12.6% yield. Get paid to wait for SACH stock to appreciate.

Read Next: Biden to introduce “Biden Bucks”?

I believe President Biden plans to retire the US dollar we know…

…and replace it with a digital “spyware” currency.

Your US dollars could be confiscated – or made worthless.

>>Click here to see how to protect your investment and retirement accounts.

P.S. Update: It is underway. On March 9, Biden signed Executive Order 14067, which could pave the way for the new US currency I call Biden Bucks. AOC tweeted her support. Dems could use this to hold onto power indefinitely. Please view this warning now.