Bear markets have always represented an excellent time for investors to go shopping.

This article was originally posted here

For the past eight weeks, we've witnessed record-breaking volatility in the stock market as a result of the coronavirus disease 2019 (COVID-19). The mitigation measures currently put in place to curb the transmission of COVID-19 have shut down most nonessential business activity and wound up pushing equities to their fastest bear market in history (just 17 trading sessions for all three major indexes).

But the thing about bear markets is that they've always represented an opportunity to buy into great businesses at a discount. That's because every stock market correction in history has eventually been erased by a bull-market rally.

With this in mind, I'd like to share the 10 brand-new stocks I chose to add to my portfolio as the stock market crashed.

1. Amazon

In my opinion, Amazon (NASDAQ:AMZN) could find its way to $5,000 a share by 2023, so how could I not add with the stock going on-sale during the stock market crash. While I appreciate Amazon's e-commerce dominance, and enjoy seeing its global Prime membership figures grow (which boosts its generally small retail margins), I'm really excited to watch Amazon Web Services (AWS) blossom.

Amazon's cloud-services segment is growing sales at more than twice the rate of e-commerce, and cloud margins are considerably higher than retail margins. As AWS grows into a larger component of total sales, Amazon should see its cash flow per share balloon from $76 in 2019 to about $201 in 2023. That's more than enough to get me onboard with this growth story.

2. Square

Credit-service providers have been clobbered by recession fears, which offered the perfect opportunity to nibble on point-of-sale solutions company Square (NYSE:SQ).

On one hand, Square's seller ecosystem continues to expand, with around $106 billion in payments traversing its network in 2019, up 25% from the previous year. What's most notable about the seller ecosystem is that Square is generating more revenue than ever from large businesses (55% in Q4 2019, compared to 47% in Q4 2017).

On the other hand, Square's Cash App is growing by leaps and bounds. The number of monthly active uses has more than tripled in two years to 24 million, while revenue per active customer has more than doubled to north of $30. Cash App will likely be the catalyst that sees Square's revenue triple over the next five years.

3. Facebook

Social media is all about eyeballs — and no company is better at generating views than Facebook (NASDAQ:FB). This is a company that ended 2019 with 2.5 billion monthly active users and 1.66 billion daily active users. Even with advertising dollars likely down significantly in the very short-term with nonessential businesses closed, there's simply no better way for businesses to reach more eyeballs than through Facebook.

The other factor here is that Facebook still has a number of key assets left to monetize. It owns four of the seven most-visited social media platform — Facebook, WhatsApp, Facebook Messenger, and Instagram — and has only aimed to monetize Facebook and Instagram, thus far. When Facebook does monetize WhatsApp and Messenger, expect sales and cash flow to explode higher.

4. American Eagle Outfitters

Although most brick-and-mortar retail is best left on the clearance rack, teen and young-adult-focused retailer American Eagle Outfitters (NYSE:AEO) has consistently shown that it has what it takes to remain relevant. While it's a streak that'll undoubtedly be broken by the coronavirus, American Eagle has reported 20 consecutive quarters of positive comparable-store sales growth, with its intimate apparel Aerie brand reporting 21 consecutive quarters of double-digit comp-sales growth.

Unlike most retailers, American Eagle remains debt-free, and it's done a top-notch job of removing excess inventory from its stores, which is a testament to the quality of the management team leading the company. With shares at levels that haven't been seen in well over a decade, I figured now was the perfect time to pounce.

5. Pinterest

Speaking of social media eyeballs, Pinterest (NYSE:PINS) reminds me a lot of Facebook in its younger days. The only exception being that Pinterest really seems to be resonating with international users. In 2019, monthly active user (MAU) count grew by 70 million to 335 million, with approximately 63 million new MAUs deriving from international markets. This is a big reason why average revenue per user in international markets rose 115% to $0.54 in 2019.

Pinterest has also just scratched the surface on its role in the e-commerce arena. Already known for its role in helping users share knowledge and interests, Pinterest should be able to utilize video and other engagement initiatives to improve consumer follow-through with product purchases.

Currently on the verge of recurring profitability, I felt now was the time to own this explosive growth stock.

6. Livongo Health

One of the newest purchases during the stock market crash that I'm most excited about is healthcare solutions provider Livongo Health (NASDAQ:LVGO). Livongo's primary audience (for now) is diabetics, of which there are 34.2 million in the U.S., along with another 88 million people showing the symptoms of prediabetes.

What allows Livongo to stand out is its ability to use artificial intelligence and a mountain of data to help its members take care better care of themselves. Essentially, Livongo elicits behavioral changes in diabetes patients that helps them live healthier lives.

Revenue data would certainly suggest that this approach is working. Preliminary sales data from Livongo of up to $66.5 million for Q1 2020 represents a more-than-doubling from Q1 2019's sales. This also follows a near-doubling in the number of members using Livongo's subscription service between December 2018 and December 2019.

7. Mastercard

Keeping with the theme of picking up attractive credit-service providers, I also added Mastercard (NYSE:MA) to my portfolio. Mastercard may not have the mammoth U.S. market share of Visa, but being second-place in the consumption-heavy U.S. market is still an enviable position. Mastercard has also done a good job of growing its share of the branded debit-card market in the U.S. since the Great Recession.

Aside from having an exceptionally long runway for growth given that a majority of global transactions are still being conducted in cash, I fancy Mastercard for being a payment processor and not a lender. By focusing solely on the processing side of things, Mastercard has removed any direct impact of rising credit delinquencies from the equation.

8. ExxonMobil

Though my track record with oil drillers is not encouraging, I decided to dip my toe in the pond with ExxonMobil (NYSE:XOM) at a roughly 16-year low.

ExxonMobil does generate the bulk of its profits from drilling and exploration, which will undoubtedly be compromised in the near-term by low crude prices. But it's also an integrated oil and gas company, meaning its downstream petrochemical and refining operations should receive a boost from lower crude pricing.

ExxonMobil also has plenty of levers its can pull to counteract what'll likely be relatively temporary weakness in the oil market. Last week, it shaved as much as $10 billion off of its capital expenditures planned for 2020, and it could always dial back its dividend to conserve cash flow.

9. MediPharm Labs

Canadian cannabis stocks have been pulverized over the past year, with many still losing money. However, extraction-services provider MediPharm Labs (OTC:MEDIF) took less than five months to become profitable after turning on the lights, which has me very encouraged for the long run.

MediPharm is a company that takes cannabis and hemp biomass and processes it for the resins, distillates, concentrates, and targeted cannabinoids that go into making high-margin marijuana derivatives, such as edibles, infused beverages, and topicals. Most of MediPharm's clients are on fixed price and volume commitments, which allows for highly predictable cash flow.

I expect the near-term to remain unsettled given the numerous regulatory issues the Canadian pot industry is contending with, but MediPharm is adequately capitalized to survive and thrive.

10. Intuitive Surgical

Lastly, there's my top stock to buy for April (which I happened to buy in March), robotic surgical system developer Intuitive Surgical (NASDAQ:ISRG).

Intuitive Surgical's moat in the assisted surgical space is insurmountable, in my view. The company ended 2019 with 5,582 installed da Vinci systems, which is far more than all of its competitors combined. When coupled with the price of these systems ($0.5 million to $2.5 million) and the training given to surgeons, there's almost no chance of customer churn.

It's also a company that simply gets better with age. Built as a razor-and-blades business model, Intuitive Surgical generates the bulk of its margins from selling instruments with each procedure and servicing its installed da Vinci systems. As the number of installed systems grows, so will the company's operating margins.

Bonus: Warren Buffett goes “all in” on one tech?

I don’t want to get too excited, but…

I believe I’ve just made a rather large discovery.

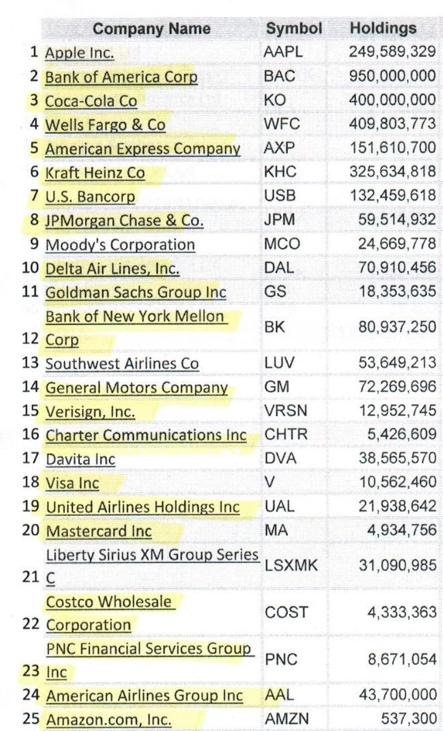

You see, for the past several months, I’ve been tracking Warren Buffett's top 25 holdings…

And what I found was surprising, to say the least.

21 of his favorite companies are going “all in” on a hot new technology…

To the tune of $1.7 billion!

This is remarkable because Buffett is notoriously “anti technology.”

(In fact, he once joked about shooting down the Wright Brothers’ first plane at Kitty Hawk!)

So, what is this new technology? And why are America’s biggest companies all in a race to implement it?

I reveal the full story in a brand-new presentation I just released.

You can see all my findings here.

P.S. Buffett isn’t the only one that’s smitten by this new tech… Apple’s co-founder called this “the future.” And the World Economic Forum projects it will grow 295,762% by 2027. But, sadly, the mainstream news has totally missed this story. Shame. You can see all the ground-breaking details for yourself right here…