Election Day is a big deal for the stock market. There is the potential for massive disruptions as leadership changes hands in the Senate and the White House. These disruptions include the potential for a huge corporate tax increase as well as the end of certain regulatory reforms.

And of course, perhaps the biggest risk is that we will not see results on Nov. 3 or even Nov. 4.

We might well see the process of ballot counting go on for days and weeks. Unsurprisingly, both sides have lawyered up and are ready to contest each and every ballot around the nation.

I am preparing for volatility in the near term. Inside my Profitable Investing, I have been positioning in several sectors and individual companies that are heads-you-win, tails-you-win stocks. This means that whichever way the election goes, these picks should continue to fare well.

In addition, I’ve been working on sectors and specific companies that are doing well with the current leadership — and are set to cash in perhaps even further with a change in leadership. What are those? One that continues to be front and center is fifth-generation (5G) wireless.

5G Stocks to Buy: Reality Over Hype

Although 5G is set to win either way, it still remains one of the more hyped technologies in the investment world. Not a day goes by when I don’t see a story about 5G and how it will transform the world.

And indices and related exchange-traded funds are rolling out at a breakneck speed. It seems firms both large and sketchy are trying to cash in on the hype over the rollout of 5G and the hardware, software and service companies associated with the wireless standard.

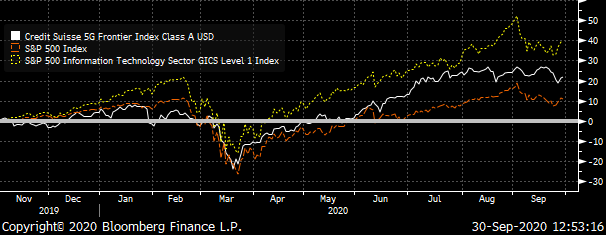

Take for example the index from Credit Suisse: The 5G Frontier Index, which it rolled out to the public last year. Source: Chart by Bloomberg

Source: Chart by Bloomberg

Credit Suisse 5G Frontier Index

While it bears the name of a major global bank and 5G, the index was trailing the general S&P 500 until mid-June. Since then, it has begun to catch up and then outperform. But a better barometer is the comparison against the S&P Information Technology Index, where the 5G index continues to trail — and trail badly. It is lagging in return by 43.8% since its inception. Source: Chart by Bloomberg

Source: Chart by Bloomberg

Credit Suisse 5G, S&P 500 & S&P Information Technology Indices Total Return

This is a warning for investors. You have to understand that 5G is not as much of an earth-changing thing as is being pitched. But at the same time, it will bring a lot of good things for users and the companies behind it. The good news is that I have already been rolling out and expanding 5G stocks to buy inside the model portfolios of Profitable Investing.

But before I explain what you should buy and own, let’s look at what 5G is doing now — and at what may follow.

Evolution, Not Revolution

5G, as noted earlier, stands for fifth generation. This follows fourth, third, second and first generations. Now, I’ve had mobile phones since either 1989 or 1990 from the Motorola bricks through to my current BlackBerry. The Motorola phones were on the old analog frequencies and were only good for voice, and they had limited range in coverage and power. And I recall the billing especially when roaming — which was nearly everywhere — was sometimes out of control.

AT&T (NYSE:T) in my Incredible Dividend Machine portfolio was one of the first digital wireless providers operating initially with Southwestern Bell under the Cingular Wireless branding. At the time, I was in Saint Louis at my bank and was an early adopter, thankfully grabbing the significantly smaller devices. Then it was on through the quick run through into early smartphones. That was transformative as email and rudimentary web access was instrumental for business.

The next big shift was in 3G — and this is quite similar to how 5G is rolling out — with very spotty coverage and constant shifts back and forth from 3G to 2G. And of course, to make it all worse, wireless was having its battle between GSM (Global System for Mobile) and CDMA (Code Division Multiple Access). AT&T adopted GSM, while Verizon (NYSE:VZ), also in my Incredible Dividend Machine, used the CDMA.

While having two modems wasn’t a big deal — for my phone — this made life working outside the U.S. a mess. The globe largely used GSM, which AT&T matched to allow roaming. But AT&T had lousy coverage in some cities including New York and San Francisco, which Verizon covered much better. My solution? A series of Verizon account phones with switches and dual sets of radio chips for inside the U.S. and outside. This didn’t work well at all.

Then 4G, also known as LTE (long-term evolution), provided a path for GSM and CDMA to converge in chips with only varied frequencies required to access roaming cell towers. But again, the switch was just a bad as 2G to 3G with dropped calls and iffy data. This is where BlackBerry (NYSE:BB) devices really came through. Their proprietary data servers both encrypted data and compressed it. So, when others around me couldn’t get access to data, me and my BlackBerry could.

Now we come to 5G. We are expecting two things.

First is a major step up in data speed and capacity. This will allow lots more to move to and from mobile devices.

Second is quicker and shorter latency. This is more important. Latency is the time it takes for a wireless device to make the connection to allow data to flow. Think of the time it takes to get a website to begin to load, and you’ll have a taste of the power or costs of latency.

Data speed and capacity will be better eventually. Videos will be nicer to download. 5G will also allow faster transmission of my filed articles.

Longer-Term Impacts of 5G

Latency will also allow all sorts of high-tech things to work — or work better. This includes autonomous cars, which will be able to communicate in real-time conditions for ongoing transportation and accident avoidance. The combination is going to provide arguably better wireless than fixed Wi-Fi.

But 5G is evolving. It will not be so easy as flipping a switch on. Even in one of the most advanced markets for wireless in the globe — South Korea — 5G is meeting resistance from adopters and users. They are citing unstable signals, as well as a lack of speed and latency improvements. In addition, handsets and modems are still quite rare and more expensive.

True 5G, which is also known as millimeter wave, is really not here yet. In the meantime, carriers such as AT&T and Verizon are rolling out stepped-up 4G under 5G labels. True millimeter-wave 5G is also severely limited by distance and objects obstructing transmission such as walls and buildings. This means two things for now. First is that millimeter-wave transmissions are being located in sports stadiums and other public venues, which has limited broad appeal.

But second, to make true 5G work, the number and locations of antennae is going to be vastly greater than for previous wireless generations. This is bringing both cost and other constraints to the rollout. However, in terms of 5G stocks to buy, this is providing plenty of opportunity.

5G Stocks to Buy: Carriers

Right now, I think that there are four primary groups of companies currently benefitting from 5G.

First up are the providers of wireless. Both AT&T and Verizon are rolling out data plans for their own 5G. The rates are higher than for current LTE 4G plans, which should bolster revenues over time. But competition is also out there.

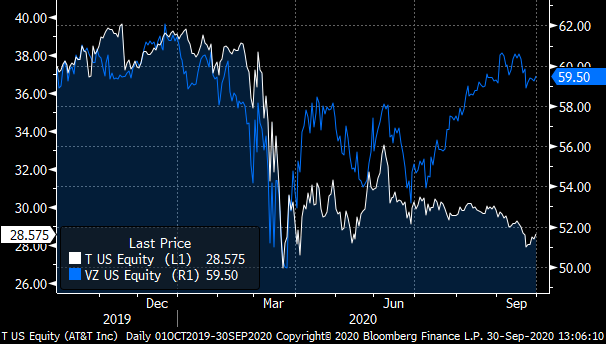

T-Mobile (NASDAQ:TMUS) finally got past its court challenges to merge with Sprint, and now it is aggressively marketing its version of the evolving 5G. This will limit pricing power for AT&T and Verizon. Importantly, it will make TMUS an attractive alternative to the major carriers. Source: Chart by Bloomberg

Source: Chart by Bloomberg

AT&T (T) and Verizon (VZ) Stock Price

AT&T, having absorbed Time Warner, is seeing overall revenues on the ascent. They are currently running at an annual rate of 6.1% despite some cord-cutting losses from its satellite and cable units. Wireless is the biggest source of revenue for the company, so 5G will bring more revenues.

But also note the company, like for Verizon, is making capital expenditures which will weigh on profits as well as debts. It has been addressing this. Operating margin is good at 15.4% — but the return on equity is a bit lower at 6.6%. This reflects some of the recent added costs. Importantly, T stock is a value at only 1.16 times book value and only 1.2 times trailing sales. And with the dividend yielding 7.3% it remains attractive to own. It is a buy in a tax-free account.

Verizon is a purer play on the communications aspect, with revenues from wireless dwarfing other communications by 3-to-1. Revenues are expanding at a slower pace than for AT&T at 0.8% over the past year. Operating margins are better at 23%, which also provides a much better return on equity, which is running at 32.1%. But this stock comes at a higher cost as it is valued at 3.92 times book and 1.9 times sales. However, it does also have a good dividend yielding 4.2%. It is a buy in a tax-free account.

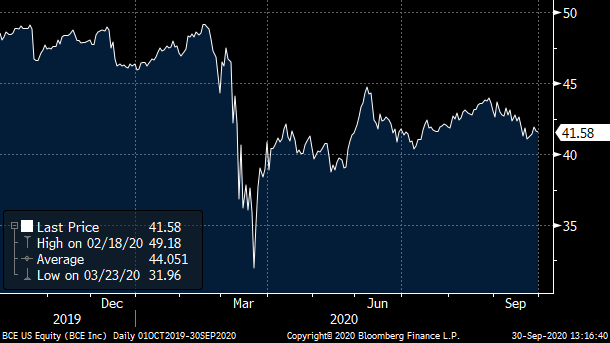

BCE (NYSE:BCE) also is in my Incredible Dividend Machine Portfolio. It is the Canadian version of AT&T with its combination of communications and content. And while its wireless contributes a smaller overall percentage of revenue, it is still quite significant and is important for the rollout and evolution of 5G in Canada. Revenue is progressing closer in line with Verizon at 2.1% over the past year. Operating margin is good at 23.3% to help make the return on equity run at 14.9%. Source: Chart by Bloomberg

Source: Chart by Bloomberg

BCE (BCE) Stock Price

The stock yields an ample 6% which continues to rise. And the stock is reasonably valued at 2.98 times book and 2.10 times sales. It is a buy in a taxable account given that as a Canadian stock, there is a risk of a change in withholding rules for U.S.-domiciled investors with qualified accounts.

5G Stocks to Buy: Equipment

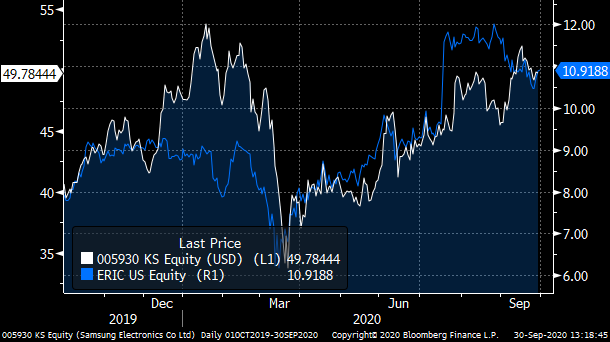

The rollout and evolution of 5G requires lots of new equipment. Huawei and ZTE (OTCMKTS:ZTCOY) are Chinese companies on the forefront of equipment for wireless. Politics is hindering both companies not only in the U.S. but in other markets. But not to worry, in my Niche Investments Portfolio I’ve already invested in two fierce competitors with Samsung Electronics (OTCMKTS:SSNLF) and Ericsson (NASDAQ:ERIC). Source: Chart by Bloomberg

Source: Chart by Bloomberg

Ericsson (ERIC) and Samsung Electronics (SSNLF) Stock Price

Ericsson was hindered for a while by it European roots. Why? It faced regulatory challenges and tax code issues. But thanks to global restrictions on Chinese products, revenues are now gaining — currently rising by 7.8%. Operating margin is improving at 3.9%, and despite investments in 5G, management now has a positive return on equity at 3.4%.

Importantly, it is a value at only 1.5 times trailing sales and 4.49 times book value, including a must-have collection of 5G equipment patents. But its dividend is not what it should be at a mere 0.7%. All of this puts the stock as one that has a lot of value and opportunity in a market where capital spending is ramping up. It is a buy in a taxable account given its foreign listing.

Samsung Electronics has been a favorite company and stock of mine for many years. It is one of the globe’s leading companies for everything from electronic devices to chips and all sorts of parts for nearly everything tech related. Not many devices exist around the globe without at least one Samsung component.

And over the past 10 years, the stock has delivered a return of 329.3% for U.S.-based investors.

It does have a challenge in that prices for memory chips around the globe are lower, which dents the revenue numbers. That said, they have been improving by an average of 5.6% over the past decade on a compound annual growth rate (CAGR) basis. Operating margins are good for such a huge company at 12.1% and in turn, the return on equity is good at 7.5%.

The dividend yields 2.4% which is good for technology. But the real attraction is that despite the stock’s price gains, it is a bargain at only 1.50 times sales and 1.3 times book value. It is a buy in a taxable account.

There are two additional 5G stocks to buy that are in the thick of equipment and data security. These are TDK Corporation (OTCMKTS:TTDKY) and BlackBerry.

5G Stocks to Buy: Behind the Scenes

5G has a lot going on behind the scenes. Companies will be using more computing and processing power. There will also be a ton of data moving around the globe. This brings me to two companies inside my Total Return Portfolio of Profitable Investing which should continue to benefit.

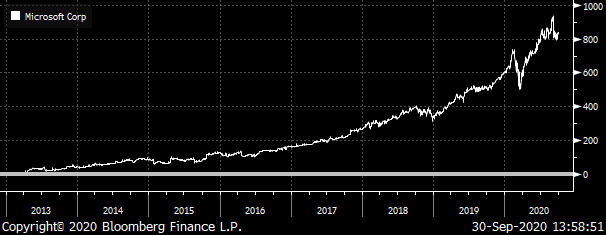

Microsoft (NASDAQ:MSFT) has its hands in a great deal of software which is used to operate networks and computing equipment. The stock has been a great success for the trailing year, with a return of 53.3%. And since I added it to the portfolio it has returned a whopping 841% for an average annual equivalent return of 33.1%. Source: Chart by Bloomberg

Source: Chart by Bloomberg

Microsoft (MSFT) Total Return

While not a pure 5G investment, Microsoft is an integral part of the evolution. It remains a must-own in a tax-free account.

Then, as just noted for Microsoft, cloud computing is an integral part of the usage of 5G networks for data calculations, storage and transmission. And this means data centers, which Microsoft and so many other companies use for the cloud to work, including over 5G networks.

This brings in Digital Realty (NYSE:DLR) which is a real estate investment trust that owns and leases out its data centers. The stock has returned 58.3% since I added it to my Total Return Portfolio in 2018. Source: Chart by Bloomberg

Source: Chart by Bloomberg

Digital Realty Trust (DLR) Total Return

Revenues are climbing, with gains running at 18.9% on average over the past five years alone. This is fueling a great return on funds from operations (FFO), which measures profits from actual properties excluding one-off additional gains. And while gaining in value, its price-book ratio is not far off the average for the US REIT Index.

The dividend yields 3.05% which, like for all U.S. REITs, has a 20% deduction in taxable income as part of the Tax Cuts & Jobs Act of 2017 . This makes the yield even more attractive on a taxable equivalent basis. It is a buy in a taxable account.

5G Stocks to Buy: Location, Location, Location

As noted earlier in this section, 5G requires a much greater number of antennae to work both inside structures as well as outside. Now, there are companies with cell tower assets that currently carry 4G and other wireless transmissions. But it is interesting to note that these tower facilities are not all that compatible with 5G, particularly in suburban and urban markets.

I have been following the developments of 5G antennae locations. And while I am not done, I have been learning more and more about leases for locations for antennae particularly in lucrative urban markets. And one of the lesser discussed beneficiaries are commercial and other urban property building owners in the REIT space.

This includes my long-time favorite WP Carey (NYSE:WPC) in my Total Return Portfolio inside Profitable Investing. WPC is one of the potential beneficiaries and, despite the slip in the REIT stocks through March 23, the stock has returned 56.66% since I added it to the portfolio. Source: Chart by Bloomberg

Source: Chart by Bloomberg

WP Carey (WPC) Stock Price

This WPC one of my favorite — bargain — 5G stocks to buy. It is valued at only 1.67 times its intrinsic value of all of its properties and related assets And yielding a tax-advantaged 6.4%, it is a good income generator. Buy WPC stock in a taxable account.

Related: 5G Surprise: Even Bigger Than my Extraordinary 20,130% Apple Trade?

HOLD ON!

I think of this 5G opportunity as the “new Apple”

If you joined me back when I first recommended Apple, you could have enjoyed an extraordinary 20,130% price explosion if you had held on over the years.

That’s enough to turn a $10,000 stake into $2,023,000!

Now that 5G is ready for takeoff…

My research suggests we’re staring at an opportunity of this magnitude again — if not even greater.

It all hinges on this shiny device…

Go Straight to the Exciting Story

It’s tiny, less than 1 inch wide by one-quarter inch tall…

But I have compelling new evidence that this so-called “smart antenna” could become the #1 tech sensation of the decade!

Remember, I’m the guy with a knack for spotting the Next Big Thing — just look at these extraordinary examples our firm spotted…

• Amazon… before it shot up 3,972%

• Intel… before it shot up 1,516%

• Netflix… before it shot up 24,221%

• Apple… before it shot up 20,130%

This one could be the granddaddy of them all! Go HERE to see why.