It's best to view a stock's share price as kind of like the numerator in a fraction. You're not going to make much sense of it without the denominator.

But even that analogy falls short. There are actually multiple factors in addition to the share price that you need to know to determine if a stock is attractive. Market cap and addressable market are just a couple of them.

A low share price doesn't necessarily correlate to a smart pick. However, there are some stocks with relatively low share prices that have what it takes to be big winners. Here are three stocks available for under $20 that could make you a fortune over the long term.

IMAGE SOURCE: GETTY IMAGES.

1. Jushi Holdings

Jushi Holdings (OTC:JUSHF) claims the lowest share price on our list. You can buy one share of the marijuana stock for less than $5. And Jushi gives you a lot of bang for those few bucks.

The company is a multi-state cannabis operator (MSO) with 24 retail cannabis locations. Fifteen of those dispensaries are in Pennsylvania. Jushi also operates in California, Illinois, Massachusetts, Ohio, and Virginia. It recently signed a deal to acquire Apothecarium Nevada. This deal will add another state and licenses for another 12 retail locations to the list.

Jushi's revenue more than tripled year over year in the second quarter and jumped nearly 15% from the previous quarter. The company expects to generate revenue of between $375 million and $425 million in 2022, up close to 78% year over year from projected revenue this year.

With its market cap currently below $730 million, Jushi's near-term growth prospects make it a bargain. Over the long term, the company should continue to have great opportunities — especially with Virginia's adult-use recreational marijuana market opening in 2024.

Crash Warning: Everything just changed

Stocks plummeted this week. Investors are terrified.

And Morgan Stanley just announced that a “20% drop in the S&P 500” could happen any moment.

If you’re a student of history, you likely recognize the signs.

And it’s time to prepare for a market moment that could define your wealth for the next decade.

A small group of U.S. investors are in line to receive advance notice of the exact day of the next market crash.

For a limited time, you can see it for yourself, 100% free. Click here for the exact day stocks will crash in 2021.

2. Cresco Labs

Cresco Labs (OTC:CRLBF) stands out as another cannabis company with a low share price of less than $10. Like Jushi, Cresco is growing fast with strong future prospects.

The company ranks as the top wholesaler of branded cannabis products in the U.S. It's also one of the largest MSOs, with operations in 10 states. These states include six in the top 10 based on population.

Cresco's sales in the second quarter skyrocketed nearly 18% sequentially and 123% year over year to $210 million. Unlike many cannabis operators, it's already profitable with earnings of $2.7 million and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $45.5 million in Q2.

The company thinks that it's on track to have an annualized revenue run rate of $1 billion by the end of this year. Cresco's market cap is around $2.5 billion. This is without question one of the most attractively valued pot stocks around.

3. SoFi Technologies

Not every low-priced stock with strong growth prospects is in cannabis. SoFi Technologies (NASDAQ:SOFI) is a fintech disruptor with a share price of around $17.

The company operates a one-stop shop platform that supports a variety of financial services. Customers can secure personal and home loans, refinance student loans, manage their cash, and invest in stocks, exchange-traded funds (ETFs), and cryptocurrencies online.

SoFi posted record net revenue in Q2 of $231.3 million, more than doubling from the prior-year period total. It achieved member growth of 113%, accelerating for the eighth consecutive quarter.

The company could have an especially big opportunity with its Galileo business. Galileo offers a digital payments platform to fintech customers. SoFi hopes to soon win a banking license, which would allow it to be the sponsoring bank for Galileo's partners to offer credit cards. This fintech stock could grow much larger than its current market cap of around $13.5 billion.

Should you invest $1,000 in SoFi Technologies, Inc. right now?

Before you consider SoFi Technologies, Inc., you'll want to hear this…

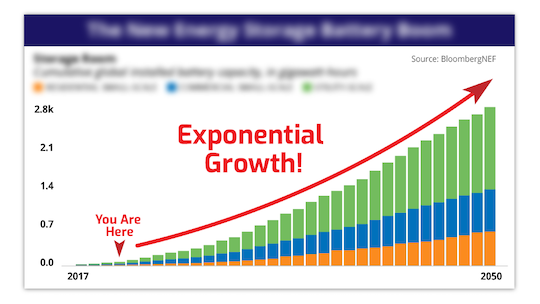

BESS: The #1 Investment For The Next 30 Years

Sponsored

- It’s a ground floor opportunity (that according to Bloomberg) is set to soar 12,100% over the next 30 years.

- It lies at the center of a new digital network (that Cisco predicted over a decade ago) will grow up to 1,000X larger than the internet

- It’s set to kick off what Citigroup calls a $100 trillion disruption