These companies will create value as they have strong fundamentals and a positive business growth outlook

- These are the stocks under $10 to buy, for those with an investment horizon of 12-24 months.

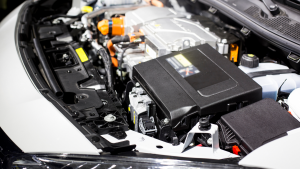

- Solid Power (SLDP): Focused on the commercialization of solid-state batteries with strong automotive partners.

- Tilray Brands (TLRY): Operating and free cash flow positive in Q2 2023, with an impending legalization catalyst.

- Marathon Digital (MARA): Mining capacity to more than double from current levels before the end of the year.

- Borr Drilling (BORR): Order backlog of $1.7 billion and 50% adjusted EBITDA margin guidance for 2023.

The market continues to present attractive investment opportunities in the growth stocks realm. Recently, I have been screening stocks under $10 to buy. Surprisingly, there are plenty of quality stocks to choose from in this group, with solid business fundamentals.

A big reason to explore this segment is to create a diversified portfolio with limited funds. And while 2022 has been challenging for growth stocks, and economic headwinds persist, sentiment has been much more favorable over the first quarter of 2023. This has translated into significant undervaluation for a number of quality growth stocks.

As sentiment reverses, multiple stocks under $10 are poised for robust returns. For example, several crypto stocks have been out-performers in the first two months of 2023, with returns ranging from 50% to 100%.

There are likely to be more segments that hold value and are poised for a breakout. From a conservative view, I believe these stocks under $10 are likely to double within 24 months.

Let’s discuss the catalysts for big breakout rallies in these names.

Editor's Note: Putin just screwed up royally…even for him

I wanted to email you today because I just discovered something very big that could affect the markets in the weeks ahead.

In short… Vladamir Putin has made a major mistake… even beyond his invasion of Ukraine.

It's going to cost the Russian economy trillions of dollars.

It's already sending energy prices skyrocketing.

A single energy stock is expected to benefit so much from this situation… that Wall Street analysts now are projecting the price to go from $30 to $280 in just 18 months.

The company has seen a 2,400% jump in profits.

And thanks to an incredibly unique situation… those profits are expected to grow even further.

I recently did an interview with best-selling author and journalist Bob Paff explaining the entire situation.

I suggest you make some time to watch it today.

Because this stock very well could be the single best performer of the coming year.

Watch my interview right here.

Solid Power (SLDP)

Solid Power (NASDAQ:SLDP) has also witnessed positive momentum in the year’s first two months. Excellent news has backed the upside, and SLDP stock still looks undervalued.

As an overview, Solid Power is in the development stage of solid-state batteries. The company’s research and development effort is backed by BMW (OTCMKTS:BMWYY) and Ford (NYSE:F).

An important point to note is that Solid Power commenced EV cell production in Q4 2022. The company expects to deliver EV cells to automotive partners for validation testing during the year. This is a massive potential upside catalyst for its stock.

Of course, potential delays in the commercialization of solid-state batteries is a risk. That said, in December 2022, Solid Power signed an expanded research agreement with BMW. Under this agreement, the former will license the cell design and manufacturing process to BMW. With parallel research, there is a strong case for accelerating commercialization.

Solid Power ended 2022 with cash and equivalents of $496 million. Thus, the company has ample financial flexibility to fund research for the next 24 months.

BREAKING: Biden on video ordering secret military move on Russia?

Tilray Brands (TLRY)

Tilray Brands’ (NASDAQ:TLRY) stock has seemed to be in consolidation mode over the last six months. That said, a breakout on the upside appears imminent, and TLRY stock can quickly double.

A long impending catalyst for stock upside is potential federal level legalization of cannabis. In a legalization scenario, I see TLRY stock trading well above $10. However, business developments have been positive, even if legalization continues to be delayed.

For Q2 2023, I believe that the most crucial development was related to the company’s cash flows. Tilray Brands reported positive operating and free cash flows of $29.2 and $25.4 million, respectively. The stock is likely to be re-rated further, as cash flows swell with operating leverage.

Tilray has a broad addressable market with an increasing presence in the U.S. and Europe. The company has acquired two brewing companies in the U.S. in the last few quarters. This has boosted the company’s strategic infrastructure in the country. In Europe, the company is likely to be among the leading players in the medicinal cannabis segment.

Marathon Digital (MARA)

Bitcoin (BTC-USD) has witnessed some positive momentum in the recent past. A weak dollar and an upcoming Bitcoin halving in 2024 are the critical catalysts for the cryptocurrency to trend higher. Several Bitcoin mining stocks, therefore, look attractive.

Marathon Digital (NASDAQ:MARA) stock looks attractive, and has already surged by over 80% for year-to-date 2023. I believe that this positive momentum is likely to be sustained as the company expands its mining capacity.

As of February 2023, Marathon reported a mining capacity of 9.5EH/s. The company continues to guide mining capacity expansion to 23EH/s in the next few months. Even if this capacity expansion happens throughout 2023, Marathon is positioned for solid growth.

From a financial perspective, Marathon reported unrestricted cash of $219.7 million as of February. For the same period, the value of digital assets was $191.2 million. The company has therefore navigated challenging times with substantial financial flexibility.

BREAKING: Biden on video ordering secret military move on Russia?

Borr Drilling (BORR)

Borr Drilling (NYSE: BORR) stock has skyrocketed by 190% in the last 12 months. However, the stock still remains undervalued, and I think this is another name that can double in the next 12-24 months.

As an overview, Borr Drilling provides offshore drilling rigs to oil and gas companies. With oil sustaining around $80 levels, offshore exploration activity remains robust. This has translated into a reversal in revenue and EBITDA for Borr Drilling.

For 2022, Borr reported revenue of $443.8 million. The company has guided for revenue (mid-range) of $760 million for the current year. Further, adjusted EBITDA is expected at $380 million. With robust revenue growth and substantial margin expansion, the outlook for this company is bright.

It’s worth noting that Borr closed 2022 with an order backlog of $1.7 billion. On a year-on-year basis, this backlog swelled by 200%. If the company’s backlog growth remains robust, BORR stock will continue to climb higher on expanded revenue visibility.

Strong Buy: “Future Fuel” will unleash $11 trillion wave of wealth

The last time this happened, investors made 41,405% gains

A brand new type of fuel has just been created that could put Tesla out of business.

Forbes, CNN, and Nature Magazine are calling it the “fuel of the future.”

And this “Future Fuel” is set to unleash an energy revolution that Goldman Sachs estimates will be worth $11.7 trillion.

That's 10X bigger than the electric battery market.

Don't forget – Tesla has returned 41,405% to shareholders over the last 10 years.

But the amount of wealth up for grabs from the “Future Fuel” revolution could put those returns to shame.

That's why billionaires like David Shaw and Jeff Yass are pouring hundreds of millions of their own money into this “Future Fuel.”

And top Tesla executives are fleeing the company en masse in order to take part in the “Future Fuel” revolution.

They know what's coming.

They know that “Future Fuel” will mint an entire new class of millionaires – maybe even billionaires.

And early investors will make an absolute fortune.

All the details of the “Future Fuel” revolution are right here.

See how you could take part in this historic wave of wealth today.