Even amid the current stellar earnings season, electric vehicle (EV) stocks continue to impress. For the most part, this area of the stock market remains a hot one as investors look towards the next frontier of the transportation industry. From consumers to governments and even companies running logistics, EVs are becoming a go-to. So much so that investors have no shortage of news to digest this week when it comes to the top EV stocks.

Notably, Tesla (NASDAQ: TSLA) is making headlines in the stock market today, thanks to a slew of positive updates. For starters, the EV giant reportedly received a massive 100,000 vehicle order from Hertz Global Holdings (OTCMKTS: HTZZ). To explain, Hertz is a Florida-based car rental firm. By current estimates, the current order would net Tesla a cool $4.2 billion in revenue. That’s not all. Tesla is also planning to change the type of batteries used by its EVs. Namely, lithium-iron-phosphate (LFP) batteries are also significantly cheaper to produce, according to Guidehouse Insights principal analyst, Sam Abuelsamid. This, in turn, could serve to improve Tesla’s bottom line. Additionally, Morgan Stanley (NYSE: MS) analyst Adam Jonas hit TSLA stock with an Overweight rating and a $1,200 price target.

Elsewhere, other EV industry top guns such as Nio (NYSE: NIO) are rapidly expanding their operations across the globe. As of last month, the company now boasts EV retail centers and battery swapping services in Norway. Whether you are riding the Tesla hype or seeing long-term value in the industry, the case for EV stocks is growing. With that said, here are four to watch in the current market.

Top EV Stocks To Buy [Or Sell] This Week

- XPeng Inc. (NYSE: XPEV)

- ChargePoint Holdings Inc. (NYSE: CHPT)

- Volta Inc. (NYSE: VLTA)

- Ford Inc. (NYSE: F)

XPeng Inc.

To begin, we have XPeng Motors, an EV manufacturer with headquarters in Guangzhou, China. It is a leading EV manufacturer in China’s rapidly growing smart EV market and has produced many popular and environmentally-friendly vehicles. This would include its G3 SUV and its P3 4-door sports sedan. It especially caters to the growing base of technology-savvy middle-class consumers in China. XPEV stock currently trades at $47.19 as of 11:26 a.m. ET.

On Sunday, an affiliate of the company, HT Aero, announced that it will have a new flying car that can also be driven on roads. The company says it plans to release its flying car by 2024. Furthermore, it says that the car will have a lightweight design and a rotor that folds away. That will allow the car to drive on roads and then fly once the rotors are expanded. HT Aero’s new land and air vehicle was also introduced at XPeng’s Tech Day where the company also unveiled its latest version of the advanced drive assistance system called Xpilot 4.0. Given the excitement surrounding the company, will you consider investing in XPEV stock right now?

[Read More] Man Called Tesla at $50, Says Buy This EV Stock

ChargePoint Holdings Inc.

Moving on, we have ChargePoint, an EV charging company that has one of the largest EV charging networks in the world. It also provides a comprehensive portfolio of charging solutions. From its cloud subscription platform to software-defined charging hardware, its products and services include options for every charging scenario. In fact, with just one ChargePoint account, users will have access to hundreds of thousands of places to charge in North America and Europe. CHPT stock currently trades at $22.24 as of 11:27 a.m. ET

On October 6, 2021, the company announced significant milestones in its goal to become a leading EV charging company. This would include the closing of its acquisition of a leading European electric mobility platform has·to·be. has·to·be’s expansive software platform is able to address the complexity and fragmentation of Europe’s charging landscape and will be compatible with widely deployed European charging stations and e-mobility services.

Ultimately, it will help accelerate ChargePoint’s position in Europe’s charging ecosystem. The company also continued to create job opportunities and has more than doubled its talent over the past year in Europe. This is on top of state-of-the-art research and development facilities in Amsterdam, Austria, and England for testing and evaluation of ChargePoint’s EV charging products. With this being said, will you consider buying CHPT stock?

Put An Extra $1,622 A Month In Your Pocket

Voted Social Security Advisor of the Year by the Social Security Association…

It’s no surprise Beau was awarded this “medal of honor” of the finance world…

Because he’s helped thousands of folks avoid “burning” the money that’s rightfully theirs.

And to help even more people…

He’s created a FREE, 30-second quiz that could put an extra $1,622 per month in your pocket.

Simply by helping you avoid the Social Security errors that 94% of Americans make every day.

This simple quiz takes Beau’s 20+ years of experience navigating the twists and turns of the social security labyrinth… and boils it all down into a few easy tweaks you can make today…

From the comfort of your own home…

Tweaks that have the power to single-handedly upgrade your financial destiny… and ensure you have MORE than enough money for your retirement…

And today, for the first time ever, he’s releasing this simple yet powerful financial tool…

To the general public absolutely FREE. Take the 30-second quiz and claim the extra money that’s rightfully yours.

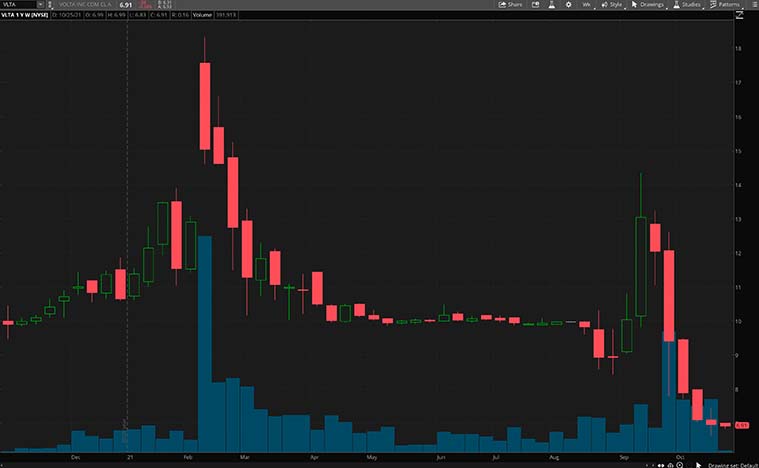

Volta Inc.

Volta is an EV company that is building the infrastructure of the future. The company is creating an EV charging network that capitalizes on and catalyzes the shift from combustion-powered miles to electric miles by placing media-enabled charging stations in prominent public locations. Furthermore, its charging stations can enhance site hosts’ and strategic partners’ core commercial interests. This would create new means for them to benefit from the transformative shift to electric mobility. VLTA stock currently trades at $6.90 as of 11:27 a.m. ET.

The company says that it is well-positioned for future growth as many OEMs and EV-first companies have taken the center stage in the EV industry. With billions of dollars of planned investments, Volta will be able to cater to a growing market of EVs in the near future. This on top of EVs eventually becoming cheaper than conventional gas cars. The company’s estimates put this by 2024. All things considered, should investors be paying close attention to VLTA stock right now?

[Read More] Man Called Tesla at $50, Says Buy This EV Stock

Ford Inc.

Another name to consider in the global EV race now would be Ford. As one of the biggest players in the automotive industry today, most auto investors would be familiar with the company. More so with its ongoing multi-billion plans to fully electrify its fleet by 2025. From its automobiles and commercial vehicles to its more premium offerings, Ford has major EV goals to meet now. Like most legacy auto-manufacturers making this shift, Ford’s stock has and continues to gain in the stock market. This is evident as F stock trades at $16.12 as of 11:27 a.m. ET with year-to-date gains of over 90%.

Given all of this, could F stock be worth investing in now? Well, for one thing, analysts over at Credit Suisse (NYSE: CS) seem to believe so. In particular, analyst Dan Levy provided a rosy update on F stock just last week, raising his rating from Neutral to Outperform. Not to mention, Levy also hit the company’s shares with a $20 price target. According to him, Ford is looking at “a favorable industry cycle” moving forward. Given this update, would F stock be a buy for you ahead of its upcoming earnings call this Wednesday?

Read Next: Woman gets revenge after 401(k) falls nearly 50%

Sponsored

In 2008, I lost around 50% of my 401(k).

I was furious, because I'd entrusted that money — the bulk of my life savings working as a director at L'Oréal — to a money manager.

My husband, Marc, saw how upset I was, and created a new investment system to help me make it all back.

Since then, I've made 3 times my money overall.

In fact, in about a year, I made 7 times my money on one stock alone, just by logging into the website my husband created to help everyday folks like me get “revenge” against Wall Street.

As you can imagine, I've told hundreds of people about the system.

At first, many people find it hard to believe you can type any of 4,000 different tickers into an online system to see exactly which stocks could make you the most money. But once they try it out… they're hooked!

That's why I'm offering you a chance to claim free access to it right here.

Marc (who spent 50 years on Wall Street) charged his former clients $5,000 a month to access the system…

But today, I'm asking Marc to make an exception.