It’s true that fifth generation (5G) telecommunications is more an advertising line than a real thing for most people. But that is changing and 5G stocks are quickly becoming a hot investment theme.

All major phone makers are making sure their newest models are 5G-ready. And telecom equipment makers are running a full speed to build out 5G equipment and networks around the globe.

What’s more, there’s another feud between the U.S. and China on 5G technology. While China has been a leader in 5G development and has already woven into telecom systems in the rural U.S., Washington is voicing concerns over the security of the networking equipment.

China says it’s simply a ploy to hamstring Chinese companies, while U.S. and European companies catch up in the 5G market.

Wherever the truth lies, there’s plenty of opportunity with 5G stocks, since China’s privately held Huawei isn’t likely to run away with all the global 5G business.

My selection of the best 5G stocks includes the following seven stocks:

- Telefon AB LM Ericsson (NASDAQ:ERIC)

- Samsung Electronics (OTCMKTS:SSNLF)

- Digital Realty Trust (NYSE:DLR)

- Corporate Office Properties (NYSE:OFC)

- BCE Inc (NYSE:BCE)

- AT&T (NYSE:T)

- Verizon (NYSE:VZ)

Editor's Note: The Best 5G Stock You've Never Heard of

5G Stocks to Buy: Ericsson (ERIC)

Source: rafapress / Shutterstock.com

One Huawei’s major competitors in the 5G equipment space right now is this Sweden-based telecom firm.

You may remember this company way back in the dotcom days (a whole 20 years ago!) when it was a juggernaut in setting up wireless networks around the globe and even offering some pretty popular mobile phones.

After the dotcom bubble burst and the first wave of mobility was over and a number of companies saw opportunity in the sector and moved in, ERIC hung on for dear life. But now, Ericsson is again a leading 5G equipment provider, supporting 55 live 5G networks, in 27 countries, including China.

ERIC stock is finally getting the attention it deserves, which means it’s still one of the and it’s up 35% in the past 12 months, near its 52-week high. There’s plenty more growth to come.

Samsung Electronics (SSNLF)

Source: JPstock / Shutterstock.com

There’s little doubt that you haven’t yet heard of this South Korea-based electronics giant.

But it’s not in this list because all of its mobile phones will be 5G-ready by the end of the year. Or that 90% of its phones will be Internet of Things (IoT) enabled.

In fact, 5G is about much more than just faster mobile phone connectivity. It will enable the next steps in multiple technological revolutions, which is a large part of why identifying the best 5G stocks to buy is so important for today’s investors.

The biggest benefit of Samsung from a 5G perspective is its 5G chipsets. It is a massive chip maker.

According to B2B networker BizVibe, Samsung is the largest semiconductor chipmaker by revenue in the world by a large margin. It has 44.8% of the global chip market, with Intel (NASDAQ:INTC) far behind in second place, with 15.5%.

The fact is, Samsung makes chips for all its own devices as well as a lot of others. Its consumer electronics is its most obvious business but its dominance in chips is significant.

And if its phones are all 5G enabled, it is also selling those chips to other phone makers.

What’s more, it also sells the networking equipment that makes 5G run.

SSNLF stock is a little more difficult to buy because it is only listed in South Korea, but its ADR is available and worth the trouble. SSNLF is up 33% in the past year and will be a strong player for many years to come.

Digital Realty Trust (DLR)

Source: Shutterstock

This real estate investment trust (REIT) is one of the leaders in hosting secure, reliable and state of the art data center properties for cloud computing, artificial intelligence, financial services, healthcare and networking.

In that laundry list you can include 5G networking equipment.

DLR estimates that there will be 75 billion mobile phones in use by 2025. And by that point they will all be using 5G technology, which is 100x faster than current 4G technology. That’s the difference between downloading a movie in 7 minutes with 4G, versus 10 seconds with 5G.

That’s a game changer. And DLR will be the company that carriers and networkers turn to for data centers that are ready for the coming 5G boom.

With 280 data centers in 22 countries on 6 continents, Digital Realty Trust will be a major player.

DLR stock is up 30% in the past year and still delivers a respectable 2.8% dividend.

Corporate Office Properties (OFC)

Source: Shutterstock

This is another REIT that is in the office property and data center sectors, but it is less than a tenth of the market cap of DLR.

However, it has a very specific niche that makes it a key 5G stock to consider. Specifically, it operates around the Washington, D.C. area to government agencies, defense and intelligence agencies and contractors.

Its top 3 tenants include the General Services Administration (the U.S. government’s real estate department) with 34% of total 2019 revenue, Amazon (NASDAQ:AMZN) at 7.9% and General Dynamics (NYSE:GD) at 4.9%.

That is the ideal tenant in today’s market. What’s more, working with the defense and intelligence communities means OFC can build out secure data centers to exactly the specifications that their clients’ need and know that they’ll get pricing to make it profitable.

However, as McCall reminds us, 5G “road builders” like OFC, DLR and others on this list are just the tip of the iceberg. They will be among the power players in the 5G revolution, but the key players he identifies with his research team are the ones that will drive on that road for years to come with their breakthrough technologies.

OFC stock is off 5% in the past year, but it delivers a 4% dividend. And many analysts are beginning to upgrade the stock in recent weeks.

BCE (BCE)

Source: madamF / Shutterstock.com

Investors often look to telecom stocks like BCE for income. After all, telecoms often pay some of the largest dividends. But that’s not the only way to find income. My book, Income for Life details more than 60 different revenue streams anyone can collect.

While you sift over all of those unique ways to make money, I’d also like to change the way you view BCE stock. Instead of looking at it as just a telecom stock, imagine its role in our upcoming 5G future.

It has been a dominant carrier for almost 40 years, it’s a household name and it doesn’t have a ton of competition.

BCE is the Baby Bell of Canada. For those of you too young to remember, AT&T (aka, Ma Bell) dominated the entire North American phone market until it was broken up into the “Baby Bells” in 1984 through an anti-trust lawsuit.

Bell Canada Enterprises was formed in 1983 and remains one of Canada’s largest companies and a dominant player in the nation’s telecommunications industry.

And now it’s set to be one of the key road builders in 5G networks. In June, it launched the largest 5G network in Canada. It’s using equipment from Nokia (NYSE:NOK), so there won’t be any trade issues with the U.S. or Europe regarding its 5G infrastructure in the future.

BCE stock is off a bit over 7% in the past year, but it has a 5.7% dividend and will be a reliable and important telecom stock in the long term.

AT&T (T)

Source: Jonathan Weiss/Shutterstock

Ma Bell was such a powerful force before its breakup that there was a movie in the early 1970s where it was simply called (tongue in cheek of course) The Phone Company.

After the breakup, AT&T lost its local markets, but kept its international markets and national U.S. market. No one was thinking about mobile phones back then, so they weren’t in the deal.

The Baby Bells had a good run until the mobile wave hit. And then AT&T dove back in and became a dominant player almost immediately.

Today it has a market cap of $212 billion and is one of the bluest blue chips around. But it also has a lot more competition. That’s why it has diversified into content and streaming services.

All this has been new to this traditional telecom and it has proven to be a bumpy ride. But this is a long-term play.

T stock is off 13% in the past 12 months, but it has a secure dividend of nearly 7%. There are some near-term concerns about consumer belt-tightening and defaults, but it will endure.

Verizon (VZ)

Source: Ken Wolter / Shutterstock.com

This company was one of the Baby Bells that flourished after the breakup. Bell Atlantic, as it was called operated in a very important corridor — Virginia to New Jersey.

That meant it had all the U.S. government, all the New York businesses and offices in New Jersey, as well as Philadelphia and other key Mid-Atlantic business and population hubs.

When the mobile telecom revolution hit, it went on an acquisition spree buying up mobile territories where weaker Baby Bells couldn’t afford to launch mobile divisions.

Soon it was neck and neck with AT&T and optimizing its fiber optic network to deliver content which directly competed with cable providers.

It now carries a $240 billion market cap, yet trades at a price-to-earnings ratio of 12x. And it’s the No. 1 mobile carrier in the U.S.

It’s suffering the same challenges as AT&T regarding competition and defaults, but it has found a way to keep out of the content side (aside from online platforms AOL and Yahoo!) and maximize its platform for content providers.

VZ stock is up almost 4% in the past year and also has a rock-solid 4.2% dividend.

Read Next – 5G Surprise: Even Bigger Than my Extraordinary 20,130% Apple Trade?

HOLD ON!

I think of this 5G opportunity as the “new Apple”

If you joined me back when I first recommended Apple, you could have enjoyed an extraordinary 20,130% price explosion if you had held on over the years.

That’s enough to turn a $10,000 stake into $2,023,000!

Now that 5G is ready for takeoff…

My research suggests we’re staring at an opportunity of this magnitude again — if not even greater.

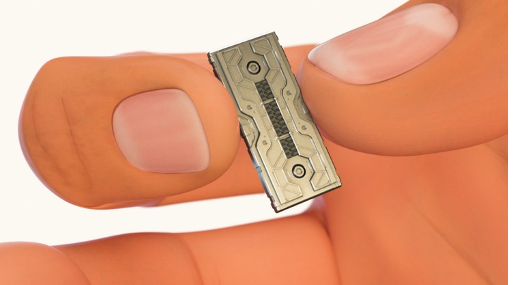

It all hinges on this shiny device…

Go Straight to the Exciting Story

It’s tiny, less than 1 inch wide by one-quarter inch tall…

But I have compelling new evidence that this so-called “smart antenna” could become the #1 tech sensation of the decade!

Remember, I’m the guy with a knack for spotting the Next Big Thing — just look at these extraordinary examples our firm spotted…

- Amazon… before it shot up 3,972%

- Intel… before it shot up 1,516%

- Netflix… before it shot up 24,221%

- Apple… before it shot up 20,130%

This one could be the granddaddy of them all! Go HERE to see why.