Coronavirus crisis-induced work-and-learn-from-home necessity led growth in demand for cloud services has compelled data center operators to bolster their cloud-storage capacities. This has bolstered chip demand from data center operators.

In fact, semiconductor companies, including Intel (INTC) , Advanced Micro Devices (AMD) , and Taiwan Semiconductor Manufacturing Company Limited (TSM) , delivered blockbuster performance in the second quarter driven by strength in data center vertical.

Moreover, momentum in high performance computing (HPC) applications, gaming, wearables, drones and VR/AR devices due to the coronavirus crisis, which has led to increase in usage of online services globally, is fueling massive growth in the semiconductor space.

Further, evolution of semiconductor manufacturing processes from 10 nanometer (nm) to 7 nm and even 5 nm technology is opening new business avenues. The accelerated deployment of 5G technology is anticipated to spur further growth. Additionally, improvements in DRAM and NAND pricing are acting as tailwinds for semiconductor stocks catering to memory market.

Also, spike in worldwide sales of semiconductors buoys optimism. Notably, per data from The Semiconductor Industry Association (SIA), global semiconductor industry sales were $103.6 billion in second-quarter 2020, up 5.1% on a year-over-year basis. According to World Semiconductor Trade Statistics (WSTS) data, annual global semiconductor sales are expected to witness growth of 3.3% and 6.2% in 2020 and 2021, respectively.

The optimism surrounding semiconductor stocks can also be ascertained by the robust performance of iShares PHLX Semiconductor ETF (SOXX) on a year-to-date basis, which has rallied 20.6% compared with the SPDR S&P 500 ETF’s (SPY) rise of 5%. Further, SPDR S&P Semiconductor ETF (XSD), which tracks the S&P Semiconductor Select Industry Index, has gained 18.8% year to date.

Considering growth prospects of the chip makers driven by data center boom and HPC push, it makes sense to invest for long-term gains. Here, we have shortlisted four stocks that are incredible for investing at the moment.

Our Picks

Advanced Energy Industries (AEIS) is benefiting from strong momentum across semiconductor equipment, data center, and industrial and medical verticals. Also, strengthening momentum across hyperscale customers is driving the company’s Data Center Computing revenues.

Moreover, synergies from Artesyn Embedded Power buyout and deep engineering capabilities in the data center market are expected to aid the company in sustaining momentum in the telecom and data center space.

Rising investments in foundry/logic and NAND memory is a major positive. Further, solid demand for critical care medical devices is a tailwind for this Zacks Rank #1 (Strong Buy) company.

The Zacks Consensus Estimate for 2020 earnings has been revised upward by 38.3% in the past 60 days to $3.83 per share.

Micron (MU) is gaining from solid memory-chip demand from data-center operators as more and more workers and students work and learn from home amid coronavirus-led social distancing measures adopted globally.

Furthermore, it is well poised to benefit from the resurgence in DRAM demand, backed by a progress in customer inventory adjustments in the cloud, graphics and the PC markets. Increasing mix of high-value solutions, enhancement in customer engagement and improvement in cost structure are positives.

Growing demand from cloud-computing providers and acceleration in 5G adoption are also contributing to the performance of this Zacks Rank #2 company.

The Zacks Consensus Estimate for fiscal 2020 earnings has been revised upward by 12.3% in the past 60 days to $2.73 per share.

Taiwan Semiconductor Manufacturing Company, the world's largest chip foundry, is gaining from strong momentum in data center chips and 5G infrastructure products.

Strength in the company’s 5 nm and 7 nm technologies is bolstering performance across 5G smartphone, HPC and Internet of Things verticals.

Deal wins from NXP and AMD remain noteworthy. The company currently carries a Zacks Rank #2 (Buy).

The consensus mark of $3.14 per share for 2020 earnings has been revised upward by 12.1% in the past 60 days.

Analog Devices (ADI) offers robust power protection, optical network control, sensor and connectivity infrastructure and DC-DC power conversion solutions utilized in high density servers, storage and networking equipment, which enable data center operators to boost efficiency.

Further, growing power design wins are major positives for this Zacks Rank #2 company. Notably, it has inked deal to acquire Maxim Integrated Products (MXIM) . The deal is expected to drive Analog Devices’ growth across several emerging markets.

Additionally, rising adoption of advanced radio systems in 5G infrastructures is driving growth of the company’s communication business. It remains optimistic about growth opportunities related to 5G.

The consensus mark of $4.68 per share for fiscal 2020 earnings has been revised upward by 9.6% over the past 60 days.

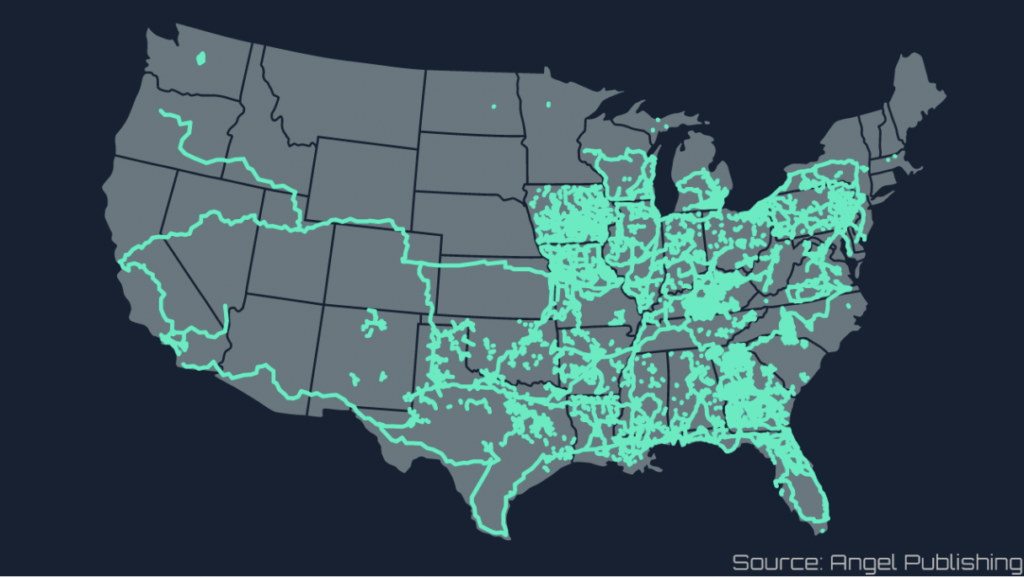

Read Next: The Best 5G Stock You’ve Never Heard Of (And It's Only $8)

I’ve uncovered what could be the most promising stock in the 5G market.

It’s a single play that will let you earn money from every single company in the 5G sector.

But get this, I’m guessing that only one in 36,000 people even know this company exists.

This is your chance. This company is poised to go vertical. They’ve already inked contracts with some of the biggest, most successful media companies.

Huge corporations — T-Mobile, Cox, Sprint, and dozens more — are all ready to cough up billions of dollars for just a piece of the tech this small company has to offer.

But here’s the kicker:

This company is still trading for less than $10 a share.

If you’ve got a ten in your pocket (or, better yet, $20!) you can get your foot in the door with this unbelievable profit opportunity.

I’ve compiled all of my research on this firm, data, statistics, the ticker symbol, and even my target buy and sell prices.