The investing world was turned on its head this week when news broke that Warren Buffett, the legendary “Oracle of Omaha,” had been quietly selling off a sizable chunk of his Bank of America (BAC) stock. Over the past few months, he's unloaded a whopping 15% of his BAC holdings, raking in over $6 billion in profit. Naturally, this sparked a frenzy of speculation. Is Buffett losing faith in the financial sector? Is this a sign of a looming recession?

While some investors are scrambling for the exits, we at “Today's Top Stocks” see this as a golden opportunity. You see, Buffett is famous for being a value investor, scooping up undervalued companies and holding them for years, but sometimes even the Oracle of Omaha misses the mark. That's what we believe is happening with Bank of America.

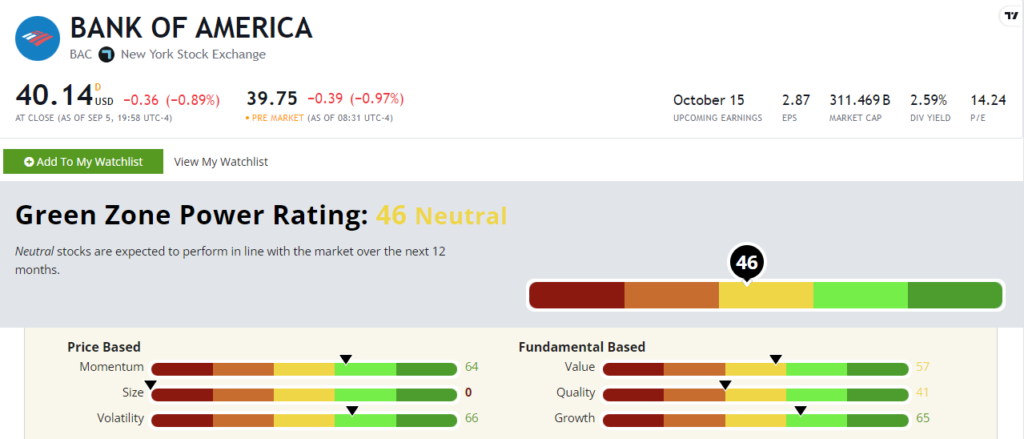

Our resident chart guru and value investing expert Matt Clark looked at this very stock in his recent article, “Why Did Buffet Sell 15% of His BAC Stock?”, concluding that BAC still has plenty of upside.

Here are three reasons why we believe you should be buying this dip, not selling :

Bank of America (BAC): A Dividend Powerhouse Primed for Growth

First, BAC is a dividend powerhouse. While the recent selloff has pushed shares down, it has also increased the dividend yield, now just shy of 6%. That's the kind of passive income that puts a smile on any self-directed investor! But we're not just after the dividend. We see significant growth potential ahead, particularly with the Fed expected to start cutting interest rates soon.

As Matt Clark astutely observed, Bank of America's recent performance has been stellar, with the stock soaring 50% since October 2023, almost double the performance of the broader market.

“According to LSEG data, Buffett’s conglomerate has sold 150.1 BAC million shares since mid-July for profits north of _$6 billion_.” – Matt Clark

Bank stocks have historically performed incredibly well in rate-cutting cycles, as we've seen multiple times in recent decades. This time should be no different, and Bank of America is perfectly positioned to benefit from this trend.

Clark also points out that many of the bank's key metrics related to profitability, margins, and returns have declined somewhat over the last year, possibly a factor in Buffett's decision. However, we disagree with this reasoning.

While some of these metrics have moderated, they are all still above industry averages and are simply a result of the bank's success in managing risk.

The bottom line is that while Buffett may be apprehensive, we see Bank of America as a fundamentally strong company with a bright future.

Don't Miss Out on this Opportunity

Don't fall into the trap of blindly following the herd, even when the herd is led by a legend like Warren Buffett. This sell-off is creating a rare opportunity to scoop up shares of a blue-chip stock with a solid dividend and impressive growth potential at a discount price.

Download our free report today: “3 MORE Stocks Buffett is Selling (But You Should Be BUYING!)”

But that's not all… tomorrow, we'll reveal why the Fed's next move could be a KILL SHOT for the dollar! We'll also tell you where to hide out (and potentially 3X your money) before it's too late. Don't miss it!