The numbers are coming in and they are grim.

We already know that second-quarter earnings results are going to be a disaster, yet we’ll get the “better than expected” bumps.

It’s absurd when profits are plunging into steep losses, but earnings hype has always been a charade.

What I want to highlight are the “big picture” numbers emerging and, boy, are they scary.

While we’re talking about what corporations are up to, we can look at the first nightmarish number.

$1 trillion. That’s how much new global corporate debt is expected to grow this year, equivalent to a 12% jump, according to a new corporate debt index of 900 companies created by Janus Henderson, a major global asset management group.

It would be one thing if this was a reversal of a trend. Instead, it represents an acceleration. Last year saw an 8% rise driven by M&A and share buybacks fueled by debt.

Companies in the corporate debt index already owe almost 40% more than they did in 2014 and debt growth is far outpacing profit growth.

Debt relative to shareholder finance is up to a record 59% for 2019’s figures. The percentage of profit devoted to servicing debt hit a new record high with it.

This is a wildly unsustainable trajectory, and any reversion means painful cuts to everything from dividends, to profit margins, and that wonderful thing that actually leads to long-term growth — capital expenditures. Remember those?

The Federal Reserve is creating an asset and debt bubble directly related to this new borrowing surge. It geared up for panic mode back in March as lenders froze new issuance, but the Fed didn’t react to corporate lenders reverting back and lending money to just about anyone that wants it.

Now debt is virtually free for all but companies that can’t even muster enough free cash flow to cover their interest payments, and even then debt for these so-called zombie companies is cheaper than it was for top-rated companies in decades past.

The number of zombie companies is growing, and it will get far worse with any increase in interest, effectively trapping the Fed into allowing the debt bubble to endlessly grow. The effect will spill over into the burgeoning asset bubble.

Buy $1,600 “Tier 2 Gold” For $8.10 Per Ounce

When gold prices start going up (which some already are)… your return on this Tier 2 gold will be much higher than if you had bought gold the normal way. You can expect huge returns of 512%, 627%, 832%, 3,900%, and even 7,042%. Click ‘Watch Now' to see how you can join the next gold rush.

How does all this look for the Fed then? Its balance sheet, and thus ours as lowly taxpayers in an indirect way, jumped from $4 trillion to $7 trillion so far this year.

Speaking of what we owe, the U.S. government just borrowed as much in June as it normally does in an entire year.

With three months left in the fiscal year, the $2.7 trillion deficit has surpassed the last record sum of $1.4 trillion in 2009. It’ll hit $3.7 trillion without any additional spending commitments.

All of this is strong evidence that we’re being locked into a death spiral. One that the market is concealing.

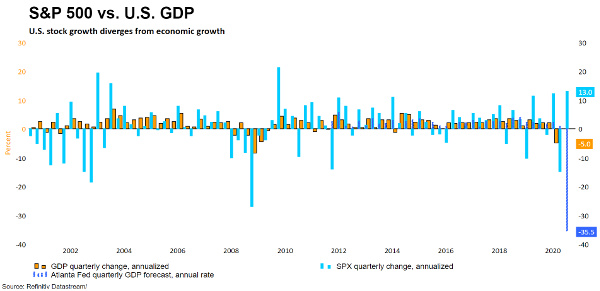

While stocks haven’t been as expensive since the Dot Com bubble, sitting at a forward price-to-earnings ratio of 21.5, we’ve never seen such a massive divergence between economic reality and valuation.

I’m not here to talk politics or policies. We’re all adults and make up our own minds. If anyone has a solution there are some pedestals without statues we can repurpose for them. They’d have earned it.

One thing is for sure though. If we need to or not, this is the equivalent of burning down our home to keep warm.

The trends we are seeing now are virtually guaranteed to be locked in for years to come. However, it is not just the dire negative ones. There are positive trends we can use to our advantage.

Gold has been surging up and all the data points to it being the start of a multi-year, if volatile, trend.

Get some exposure to the best gold investments now. We’re just getting started, and it’s going to get ugly.

Take care,

Adam English