Apple Inc. (AAPL), a tech behemoth and one of the most valuable companies globally, has recently experienced an 11% decline from its all-time high earlier this year.

Here’s why this dip presents a potentially attractive buying opportunity for investors:

1. Historical Resilience: Apple has a proven track record of bouncing back from temporary setbacks. Historically, dips in Apple's stock price have been followed by robust recoveries, rewarding long-term investors.

2. Strong Financials: Despite the recent dip, Apple's financial health remains robust. The company has consistently reported growing revenues, a strong balance sheet, and impressive profit margins. Its recent earnings reports, as discussed earlier, show continued growth in net income.

3. Diverse Product Portfolio: Apple's diverse product portfolio, including the iPhone, iPad, Mac, and a growing services segment, ensures multiple revenue streams. This diversification reduces the company's reliance on a single product and provides a cushion against potential market fluctuations.

4. Expanding Services Segment: Apple's services segment, which includes the App Store, Apple Music, and iCloud, has seen consistent growth. This segment offers higher margins than hardware sales and represents a recurring revenue stream, making it a significant growth driver for the company.

5. Innovation Pipeline: Apple's commitment to innovation is unwavering. With rumors of new products like augmented reality glasses and electric vehicles, Apple's potential market could expand significantly in the coming years.

6. Global Brand Loyalty: Apple's brand loyalty is unparalleled. The ecosystem it has created ensures that customers remain within the Apple universe, purchasing multiple products and services. This loyalty translates to predictable sales and revenue.

7. Attractive Valuation: The 11% dip from its all-time high provides investors with an opportunity to buy Apple stock at a more attractive valuation. For those who believe in the company's long-term prospects, this dip can be seen as a discounted entry point.

8. Dividend Yield: Apple has been known to reward its shareholders with dividends. Historically, Apple's dividend yield has been competitive, making it an attractive stock for income-seeking investors. And it’s currently paying about half a percent.

9. Profitability: Apple's profitability, as evidenced by its net income, has been impressive. The company has consistently reported strong earnings, driven by robust sales of its products and services. Net income has nearly doubled since 2019 and it wouldn’t surprise me if it doubled again in another 4-5 years.

Conclusion

While market fluctuations are inevitable, Apple's strong fundamentals, combined with its history of innovation and brand loyalty, make it a compelling investment. The recent 11% dip offers a potentially attractive entry point for long-term investors. As always, investors should conduct their own due diligence and consider their risk tolerance before making investment decisions.

Did you miss out on Apple?

Sponsored

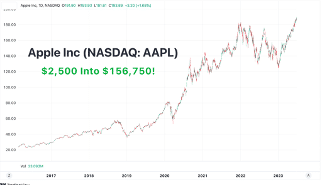

If you invested in Apple on January 9th, 2007, after the world-changing reveal of the iPhone and its IOS operating system… You could have raked in 6,170% gains – enough to turn even a miniscule $2,500 stake into a $156,750 fortune.

But if you missed out on these gains… Don't worry. Because on October 1st, a tiny company I call the “Apple of AI” will reveal something even greater (and I believe much more lucrative for investors). Click here now to see how this $2 AI stock could make you over 60x richer.