Some stocks simply have the “it” factor. They stand apart from the crowd because of their distinct competitive advantages in a fast-growing market.

These kinds of stocks become huge winners over the long run, and can also deliver strong returns in a short period of time. You don't need a massive upfront investment to profit from them. If you've got $1,000 to invest, here are three such stocks that will likely make you richer in 2021.

Sponsored

Will this weird device be in your home soon?

According to one of the smartest men I know – a man once dubbed the “Tech Prophet” by Forbes magazine – there’ll soon be millions of these devices in homes all across America.

And as they appear all over the country in the next few months, they could trigger one of the greatest wealth creating opportunities in history.

The good news is, he recently agreed to appear on camera to explain what’s going on, how it’ll impact you, and how it could make you many times richer. [Full story here]

1. Fiverr

Fiverr (NYSE:FVRR) was sizzling-hot last year, with its shares skyrocketing 730%. One key reason behind this tremendous performance was the COVID-19 pandemic. The rise of working from home, lockdowns, and job displacement spurred growth in the freelancing industry.

Freelancing has become increasingly popular over the last decade. Fiverr saw the trend developing early on and developed a software platform that connected freelancers with companies seeking digital services. It takes a cut from both the seller and the buyer of these services.

Fiverr's key competitive advantage is that it removes the friction for both sides. Freelancers don't have to bid or negotiate to win deals. Buyers get transparency on pricing, timing, and specific deliverables. Fiverr calls this approach “service-as-a-product (SaaP).”

The market potential is huge — Fiverr pegs its addressable U.S. market at $115 billion per year. Most freelancing deals are still conducted offline. With the economy potentially rebounding this year as pandemic worries subside, Fiverr should be on track to generate impressive gains again in 2021.

2. The Trade Desk

There was good news and bad news last year for The Trade Desk (NASDAQ:TTD) from the pandemic. Some advertisers reduced their spending. This hurt The Trade Desk, which runs a leading software platform for buying digital ads. However, the company still managed to gain market share — a definite plus. Investors focused more on the positives for The Trade Desk than the negatives, with the stock nearly tripling in 2020.

The continued roll-outs of COVID-19 vaccines should help the economy recover as life returns to a semblance of normality. This, in turn, should increase advertisers' confidence and spur them to loosen their purse strings. The Trade Desk is well-positioned to profit.

It's also launching one of its biggest system upgrades ever in 2021. The last time the company had a major platform upgrade in 2018, its market share soared. History could very well repeat itself this year.

The Trade Desk's long-term prospects remain very bright. Connected TV (CTV) continues to make major inroads, which is increasingly attracting advertisers. It's not surprising that The Trade Desk CEO Jeff Green stated in November that “there's no place in our business that we're more excited about than in CTV.” He has a good reason to be excited, and so do investors.

3. Guardant Health

In comparison to Fiverr and The Trade Desk, Guardant Health (NASDAQ:GH) might seem like a laggard. The healthcare stock delivered a return of “only” 103% last year. But Guardant Health's momentum is just cranking up.

The company is a leader in liquid biopsies, which analyze tumors in nonsolid tissues, like blood. Its Guardant360 CDx is the first liquid biopsy approved by the U.S. Food and Drug Administration for comprehensive tumor mutation profiling for all solid cancers. The company also markets two other liquid biopsy products.

Look for all of Guardant Health's current products to enjoy strong sales growth in 2021. They've only begun to tap the estimated $6 billion annual U.S. market.

But Guardant Health has a much bigger opportunity with recurrence monitoring and early stage cancer detection, a market projected to top $65 billion annually. The company plans to launch its first recurrence monitoring product, Guardant Reveal, in the first quarter of this year. With a market cap of around $16 billion, Guardant Health should have a lot of room to run — making investors richer in 2021 and beyond.

Where should you invest $1,000 right now?

Before you consider Guardant Health, Inc., you'll want to hear this…

Starting in 2010, Bitcoin grew from practically nothing to a $600-billion asset, and counting. (This could be even bigger.)

A money revolution far bigger than Bitcoin

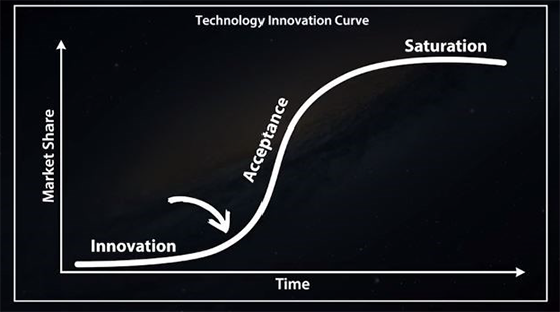

The arrow in the image below shows where the cryptocurrency market is at this time…

Right on the cusp of mass acceptance by mainstream users.

But two unrelated events are about to make select cryptos household names… and… shower investors with untold fortunes.

Due to these events more people will flock to cryptocurrencies than ever before and leave fiat money (like the dollar) in the dust.

In fact…

Business Insider says, “As many as 36% of institutional investors in the US and Europe own crypto assets.”

Tom Jessop, president of Fidelity Digital Assets, says there is now “greater interest in and acceptance of digital assets as a new investable asset class.”

And the new surge in demand along with diminishing supplies is about to send select coins to record highs.

Click here to read this developing story…

Sponsored

How To Cash In On The Tech Boom For Just $3

I'm holding three $1 bills in my hand…

Now, $3 doesn't buy much in America these days.

In many parts of the country, you can't even get a cup of coffee with that. Or a gallon of gas.

But you can use these same $3 to cash in on America’s tech boom.

That's right!

We just found a sneaky way to profit off the growth of America's top tech companies.

From tech giants … to fast-growing Silicon Valley ventures.

This little-known $3 investment has got you covered.