Here are four stocks with buy rank and strong income characteristics for investors to consider today, July 9th:

Annaly Capital Management, Inc. (NLY) : This diversified capital manager that invests in and finances residential and commercial assets has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.9% over the last 60 days.

Annaly Capital Management Inc Price and Consensus

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 18.6%, compared with the industry average of 6.6%. Its five-year average dividend yield is 12.2%.

Apollo Commercial Real Estate Finance, Inc. (ARI) : This real estate investment trust that acquires, invests in, and manages commercial first mortgage loans, and more has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.5% over the last 60 days.

Apollo Commercial Real Estate Finance Price and Consensus

This Zacks Rank #1 company has a dividend yield of 15.5%, compared with the industry average of 6.6%. Its five-year average dividend yield is 10.9%.

Apollo Commercial Real Estate Finance Dividend Yield (TTM)

B&G Foods, Inc. (BGS) : This company that manufactures, sells, and distributes a portfolio of shelf-stable and frozen foods, and household products has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.9% over the last 60 days.

BG Foods, Inc. Price and Consensus

This Zacks Rank #1 company has a dividend yield of 7.5%, compared with the industry average of 0.0%. Its five-year average dividend yield is 6.4%.

BG Foods, Inc. Dividend Yield (TTM)

Macquarie Infrastructure Corporation (MIC) : This company that provides owns and operates a portfolio of infrastructure and infrastructure-like businesses has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.7% over the last 60 days.

Macquarie Infrastructure Company Price and Consensus

This Zacks Rank #1 company has a dividend yield of 13.1%, compared with the industry average of 2.1%. Its five-year average dividend yield is 8.7%.

Macquarie Infrastructure Company Dividend Yield (TTM)

Editor's Note:

Bonus Pick: Required by law to pay you upfront

Today, and for a limited time…

You can learn one of the greatest wealth secrets in our business.

It’s one of the only ways we know to get paid instantly, every time you make a simple transaction — with total certainty, and required by law.

Once you see how it works…

You’ll have a low-risk way to generate potentially thousands of dollars upfront per week in extra income.

This cash — which could be anywhere from $240 to $2,475 — is deposited directly into your account when you request it…

Using a simple technique you can use on your phone or laptop at home.

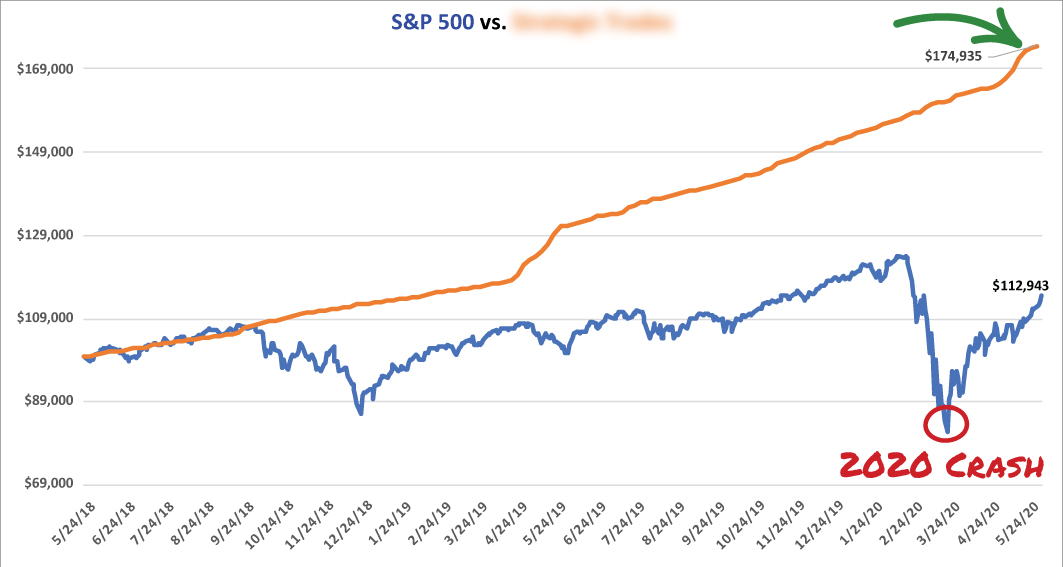

Incredibly, it also has one of the best track records in our business (check out the orange line):

During the recent crash, you would have stayed in the black.

The best part?

Right now, you can take advantage of a very special deal — just $7 — to learn exactly how this works.

However, this may only be available for a limited time.

So get the full details here, before this goes offline.