Musk: “You'll Soon Be Obsolete”

Sponsored

When the richest man in the world issues a warning, it's wise to take notice. And when he issues a warning about his own technology… well, ignore at your peril.; Elon Musk recently warned that humanity will soon be ‘obsolete.' In fact, he went so far as to call what's coming in the months ahead his ‘biggest fear.' What is Musk talking about? Well, if my research is correct, what Elon sees coming is something I'm calling a ‘silent invasion' of America. In short, every port, railroad, highway, and airport in America is facilitating a kind of ‘invasion' that will – according to one leading research firm – bring about centuries worth of change in the next few years. If Elon and the research is correct – the results could be devastating for the average American. But if you know what's coming and you act today – right now – you could preserve your wealth and perhaps even come out ahead with a few key moves. I've laid them all out in a free, short presentation. For the time being, you can access everything you need to know by clicking here. But I suggest you watch it now, because there's no telling when my publisher will take it down. Click here to see why.

P.S. The ‘invasion' I've discovered has nothing to do with the border crisis. What's happening at our southern border is a travesty, but the ‘invasion' I've found will have 10 times greater effects on our economy, and ultimately our way of life. Go here to see why.

By Anthony Di Pizio, The Motley Fool

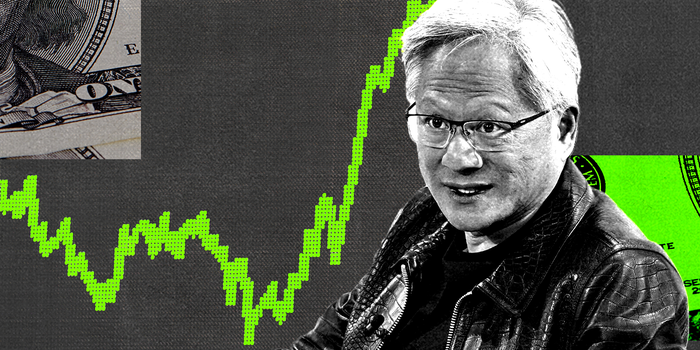

Nvidia's graphics processing units (GPUs) for data centers are used to develop the most advanced artificial intelligence (AI) models in the world, placing the company at the forefront of this new technological revolution.

Nvidia has consistently delivered triple-digit growth in its revenue over the past year, catapulting the company to a whopping $2.9 trillion valuation. Now, it's spreading some of its wealth by investing in a growing portfolio of other AI stocks, including top performers like SoundHound AI and Arm Holdings.

According to a July 18 regulatory filing, Nvidia just converted a promissory note to acquire over 1 million shares in autonomous last-mile delivery company Serve Robotics (SERV -3.27%). Nvidia has now invested a total of $12 million in Serve (dating back to 2022), taking ownership of 3.7 million shares representing 10% of the entire company.

Serve stock soared 225% when investors learned of Nvidia's latest move, but should you follow the chip giant's lead and buy in?

Using AI to build a network of autonomous delivery robots

According to Statista, the U.S. food delivery industry is set to generate over $353 billion in revenue this year. DoorDash is the most popular service, with a market share of 67%, followed by Uber's Uber Eats with 23%. Both platforms rely on human drivers to pick up orders from restaurants and deliver them to customers.

Serve Robotics says drivers travel a median distance of just 2.5 miles per delivery, and its recent investor presentation poses a thoughtful question: Why do we use a 2-ton car to deliver a 2-pound burrito? The company says advancements in AI, combined with the falling cost of sensor components and data center computing power, are creating an economical market for robot-led deliveries.

Serve designed its own robots with Level 4 autonomy, which means they can safely drive on the sidewalk using AI instead of human intervention. The company deployed 100 robots in Los Angeles in 2022 as part of a pilot program, and they have completed over 50,000 deliveries on behalf of 300 restaurants. They reported just 0.5 failures per 1,000 orders (a 99.94% success rate), making them 10 times more reliable than human drivers.

Serve's robots are already available on Uber Eats in Los Angeles, but it will deploy 2,000 new robots in 2025 to enter the San Diego, Dallas, and Vancouver markets. The new fleet will be exclusively manufactured by Magna International, a $12 billion parts supplier to the automotive industry.

As part of the deal, Magna will pay Serve a licensing fee to use its technology to create other autonomous robots outside of the food delivery space, which provides Serve with a new revenue stream.

CEO Says This Is Worth 9 Amazons

What in the world could be worth 9 Amazons?

The answer is a radical breakthrough that Wired says is “the rocket fuel of AI.”

Serve generates very little revenue right now, but it's growing quickly

Serve brought in just $207,545 in revenue last year, which is a very small number, but it was almost double the amount it generated in 2022.

Its growth will accelerate significantly in 2024, because the company already produced $946,711 in revenue during the first quarter alone. The majority of that ($850,000) was attributed to the Magna licensing deal, which means Serve generated around $100,000 in revenue from its food delivery business.

While the company is clearly making progress, it's burning through cash at an alarming rate. It lost $9 million in Q1 alone after racking up $8.3 million in operating costs, which included $6.6 million in research and development spending and $1 million in admin costs. That means Serve is on track to lose substantially more than the $20.7 million it lost in 2023.

Don't rush to buy Serve stock just yet

Serve's losses are concerning because the company clearly needs substantial amounts of money to achieve scale. It just completed a $40 million equity raise from investors in April, when it was uplisted to the Nasdaq exchange from its OTC Markets listing.

Serve had a cash balance of $34.2 million at the end of April, and based on its recent losses, it could require fresh capital within the next 12 months. That means investors who buy the stock today could face significant dilution if the company has to issue more shares. On the plus side, Uber and Nvidia are two of Serve's largest investors, and it's reasonable to assume they will step in to fund the start-up as it scales.

But Serve's valuation is another reason investors should think twice before buying the stock. Following its recent 225% gain, the company now has a market capitalization of $280 million. We know for sure that Serve will generate $1.2 million in revenue from the Magna deal this year, along with potentially $400,000 in delivery revenue if we extrapolate its Q1 result.

That gives Serve stock a forward price-to-sales (P/S) ratio of 175, making it 7 times more expensive than Nvidia stock, which trades at a forward P/S multiple of 24.

While Nvidia's backing is a huge vote of confidence for Serve's business, keep in mind it's a $2.9 trillion company and it can certainly afford to lose the estimated $12 million it has invested so far. Here's a mind-boggling calculation: If you had a net worth of $100,000, it would be the equivalent of your losing $0.40. Yes, 40 cents.

So while the Serve Robotics story is exciting, its stock should be reserved for investors who have a very high tolerance for risk.

Famous VC: “Buy this Sub-$5 Play on Elon's Next IPO

Sponsored

Hey, venture capitalist James Altucher here. Want to know how to profit from what I believe will be Elon Musk's next IPO? Click here and I'll show you… Because I believe it could be bigger than Paypal, SpaceX and Tesla… COMBINED. Look, I don't know about you… But I don't think it's fair that only rich venture capitalists are already positioned to profit from this. Aren't you tired of being the last one to hear about major tech breakthroughs? Aren't you tired of hearing about these investments… Only AFTER they already skyrocketed 1,000%, 5,000%, 10,000% or more? Click here now and I'll give you all the details on the best way to play what could be Elon's Next IPO.