Musk's new company could top a trillion?

Sponsored

Elon Musk has predicted that his new venture – something I'm calling “X-9840″ – could become “a trillion dollar company.” Today, only three companies in the US are worth more than $2 trillion. Microsoft… Apple…and Nvidia. And each of those companies gave their early investors the chance to become millionaires over several decades – starting with just a $1,000 investment. That's why I believe Elon is about to mint a new round of millionaires across America with this new venture. Unfortunately, most people will end up missing out… Because this has nothing to do with electric vehicles… Self-driving cars, rockets, brain chips, or satellites. Click here to see the details because you don't have much time to act. Elon has said he could flip the switch “as early as mid 2024.”

By Adam Spatacco, Fool.com

Over the last couple of years, the technology industry has become overwhelmingly enamored with artificial intelligence (AI). In particular, semiconductor stocks have witnessed newfound growth and investors can't seem to get enough. While Nvidia is the biggest icon in the chip space right now, I see another company emerging as a superior investment over the next several years.

Let's explore why Taiwan Semiconductor Manufacturing (NYSE: TSM) — commonly known as TSMC — might be the most lucrative opportunity of all at the intersection of AI and chipmaking.

Nvidia is in the driver's seat, but…

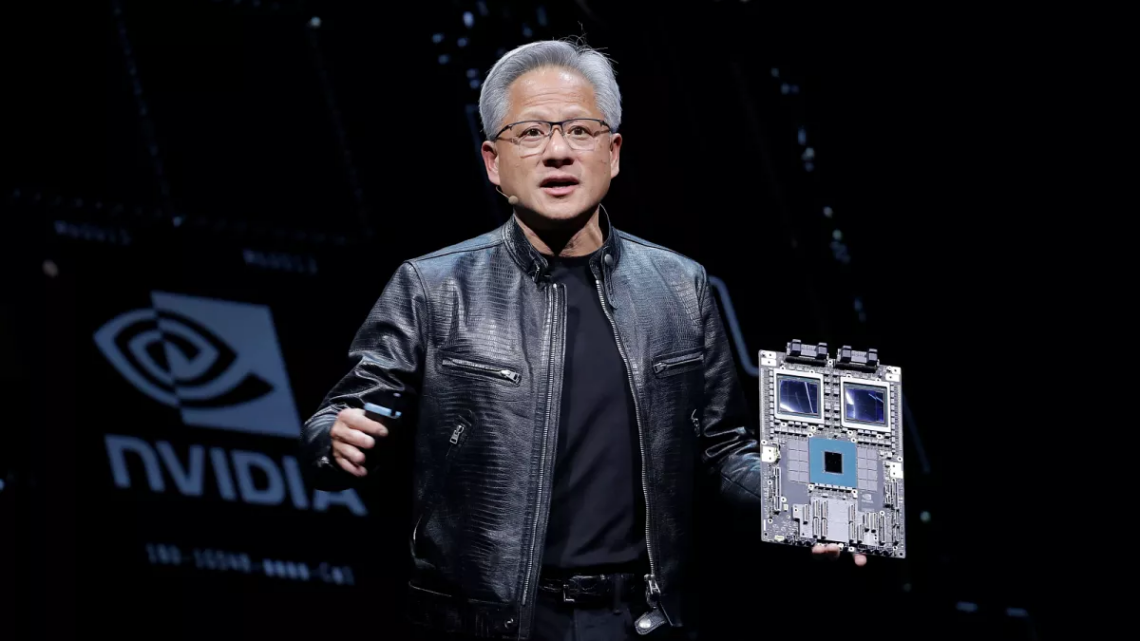

Nvidia specializes in the development of advanced semiconductor chips called graphics processing units (GPUs). GPUs are a core component across many generative AI applications such as training large language models (LLMs).

Right now, Nvidia's A100, H100, and new Blackwell GPUs are widely perceived as the best chips on the market. It's no surprise to learn that Nvidia has an estimated 80% market share in the AI-powered chip space.

Given the outsize demand for Nvidia's chips, the company has amassed significant pricing power over the competition. This dynamic has played a big role in Nvidia's current growth, as seen in the chart below.

Nvidia stock is up a staggering 157% over the last year. While there is likely still money to be made owning the stock, investors should always be thinking about the longer term.

Taiwan Semiconductor is the engine powering the car

Considering the level of growth across Nvidia's entire business, I think it's safe to say that the company is the main driver in the chip race.

However, Taiwan Semiconductor is quietly playing an enormous role in the background, fueling the car. While Nvidia designs some of the world's leading GPU processors, the company does not specialize in manufacturing. Rather, Nvidia outsources much of its manufacturing process to Taiwan Semiconductor.

TSMC operates advanced fabrication facilities where these chips are actually made. Moreover, Nvidia is just one of many leading semiconductor companies that rely on Taiwan Semiconductor. Aside from Nvidia, TSMC also makes chips for Advanced Micro Devices, Broadcom, Intel, Sony, Qualcomm, NXP Semiconductors, and Amazon.

CEO Says This Is Worth 9 Amazons

What in the world could be worth 9 Amazons?

The answer is a radical breakthrough that Wired says is “the rocket fuel of AI.”

Is Taiwan Semiconductor stock a good buy right now?

The obvious takeaway from some of the themes explored above is that Taiwan Semiconductor's services are in high demand. But the more subtle opportunity that I see is that the company's growth is really just beginning.

Nvidia faces stiff competition in the GPU and data center space, and I suspect the company's current level of momentum will eventually begin to slow. As such, I wouldn't be surprised to see Nvidia's revenue and profit acceleration start to dip over the next several years.

Conversely, Taiwan Semiconductor works with a variety of companies across the broader chip industry. Given the breadth of TSMC's customer base, I see the company as the engine powering many of these chip businesses. Therefore, I think demand for Taiwan Semiconductor's manufacturing capabilities will continue to thrive for years to come.

The one area to keep an eye on with Taiwan Semiconductor stock is its valuation. The company currently trades at a forward price-to-earnings (P/E) ratio of 24.6 — and per the chart above, there's been some clear valuation expansion throughout much of 2024.

While this could suggest that some future growth is already baked into the stock, I wouldn't get too caught up in trying to time the perfect moment to scoop up some shares.

Instead, I think using a dollar-cost averaging strategy over a long-term horizon is the optimal way to start building a position. To me, TSMC has enormous potential for the long haul and I don't see the company losing momentum anytime soon. Investors who are looking for exposure to AI and the chip space may want to consider a position in Taiwan Semiconductor and prepare to hold for the long run.

Bitcoin Gained 164% in 2023 but Crypto Millionaire Abandoned It For This

Sponsored

A certain crypto genius and millionaire has been praising Bitcoin since it was trading for $61. Even though it gained 164% last year, he's now recommending a different cryptocurrency. In fact, he's betting his own money on and buying it like crazy: >>Click here to find out what it is. [NOT bitcoin]

P.S. He's predicting an 8,788% return for this coin in the next 5 years. Find out its name here.