Every quarter, investment firms that oversee a minimum of $100 million in assets are required to disclose their holdings with the U.S. Securities and Exchange Commission. These 13F filings can be a treasure trove of stock ideas.

Microsoft (NASDAQ:MSFT) and Walt Disney (NYSE:DIS) have been favorites with two notable fund managers recently. Let's examine why.

1. Microsoft: Riding the cloud boom

One of the more widely followed hedge funds is Maverick Capital, which was founded in 1993 by Lee Ainslie. During the second quarter, Maverick Capital increased its position in Microsoft by 16%, one of the firm's largest holdings. Shares of the software giant have surged 35% year to date, and that market-beating performance comes on top of the stock's more than 300% return over the last five years. It's clear that Ainslie still sees more upside.

IMAGE SOURCE: GETTY IMAGES.

The one area that Microsoft is seeing tremendous growth in is cloud services. Microsoft is operating in the sweet spot of the digital shift happening throughout the global economy. More businesses continue to adopt cloud solutions, which has fueled Microsoft's Intelligent Cloud business to become its largest operating segment.

Microsoft's commercial cloud business grew 36% year over year in fiscal 2020, and it grew another 31% in the fiscal first quarter of 2021. The pandemic further stressed the importance of digital computing to businesses, as Microsoft CEO Satya Nadella said during the fiscal fourth-quarter conference call.

“We are seeing businesses accelerate the digitization of every part of their operations from manufacturing to sales and customer service to reimagine how they meet customer needs from curbside pickup and contactless shopping in retail to telemedicine in healthcare,” Nadella said.

As this trend continues, Microsoft is gaining market share against its top rival in cloud computing. Over the last year, Amazon‘s share has remained at 33% of the cloud infrastructure market, according to Synergy Research, while Microsoft's share has increased by two points to 18%.

Microsoft is executing a clear strategy across all facets of the business, including the Xbox gaming business, enterprise cloud solutions, and productivity software for consumers and businesses. Plus, the growth in cloud services is strengthening Microsoft's operating margin, leading to growing profits.

The stock's current P/E is 37, which looks expensive compared to the S&P 500 P/E of 31. However, Microsoft's above-average growth and competitive advantages make this tech stock worth a premium to the market averages.

IMAGE SOURCE: WALT DISNEY.

2. Disney: Doubling down on streaming

Third Point is another highly regarded hedge fund, founded in 1995 by Daniel Loeb. The firm focuses on “event-driven, value-oriented investing.” Disney is Third Point's largest reported holding; the group owned 5.5 million shares at the end of June 2020. That's a significant increase from the 1.4 million shares owned at the end of the first quarter.

It's worth noting that Third Point's position in Disney stock was reported at a share price of $111.51. Disney stock trades for $126 at the time of this writing but traded at a high of $153 in late 2019 before the pandemic disrupted this entertainment empire.

Disney faced severe challenges this year with theme park closures and movie delays, and the cancellation of sporting events disrupted the company's advertising revenue from ESPN. In the second quarter, total revenue declined by 42% year over year. Operating income fell by 72%, leaving Disney an operating profit of $1.1 billion.

Walt Disney World is currently open and management is focused on achieving positive net contribution at current attendance levels and expects demand to return when the pandemic passes. During the last conference call in August, management said it was pleased with the early results from the opening in Shanghai. Overall, theme parks are still an asset to Disney, but the growing engagement with Disney's new streaming services has forced management to invest aggressively in the future.

Disney is ramping up investment on the digital side of the business, as Disney+ now has more than 60 million subscribers less than a year since its launch. Total subscribers across Hulu, ESPN+, and Disney+ total more than 100 million.

Disney is emerging as a digital streaming giant, and that's a key reason why Third Point is so high on the stock. Loeb sent a letter to Disney recently, expressing his optimism about Disney's digital future. He believes Disney should redirect the $3 billion it spends on dividends every year toward content production for the streaming services. Disney suspended its semi-annual dividend in May, which saved the company $1.6 billion in cash to wade through the near-term turbulence.

Based on Loeb's estimates, the returns Disney generates on original content for Disney+ are multiples higher than the stock's dividend yield and therefore would drive greater returns to investors over time.

The loss in profits last quarter makes it difficult to value Disney using traditional metrics. But the momentum happening on the direct-to-consumer side makes the stock worth owning for the long term.

Read Next: UPSET ALERT – Tiny $10 firm set to win race to deploy 5G

We’ve all heard about investing in 5G.

But while everyone is talking about the fancy new 5G chips or antennas…

Nobody’s talking about the most significant piece of the 5G puzzle…

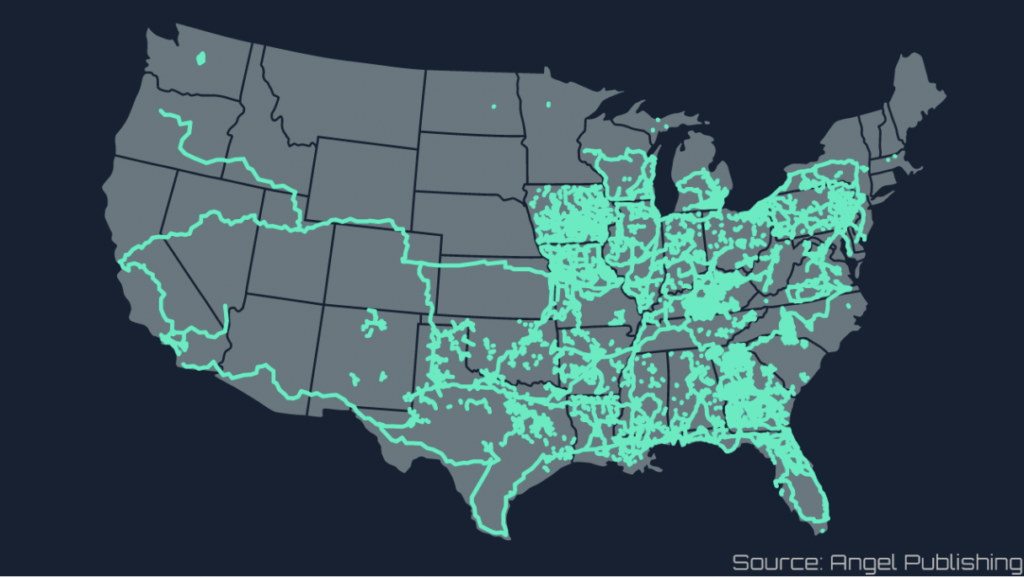

The web of networking cables crisscrossing the country that will bring information from all over the world right to your fingertips.

This is the backbone of America’s 5G network.

It simply can’t be built without those fiber-optic connections.

And there’s one company that literally owns this entire fiber network.

All of the wireless carriers and pretty much every big name in communication already have contracts in place with this company.

In fact, the ONLY cities in the entire country with 5G coverage are located right on this company’s fiber network.

Even the U.S. government is paying to get its secured communications on this critical piece of infrastructure.

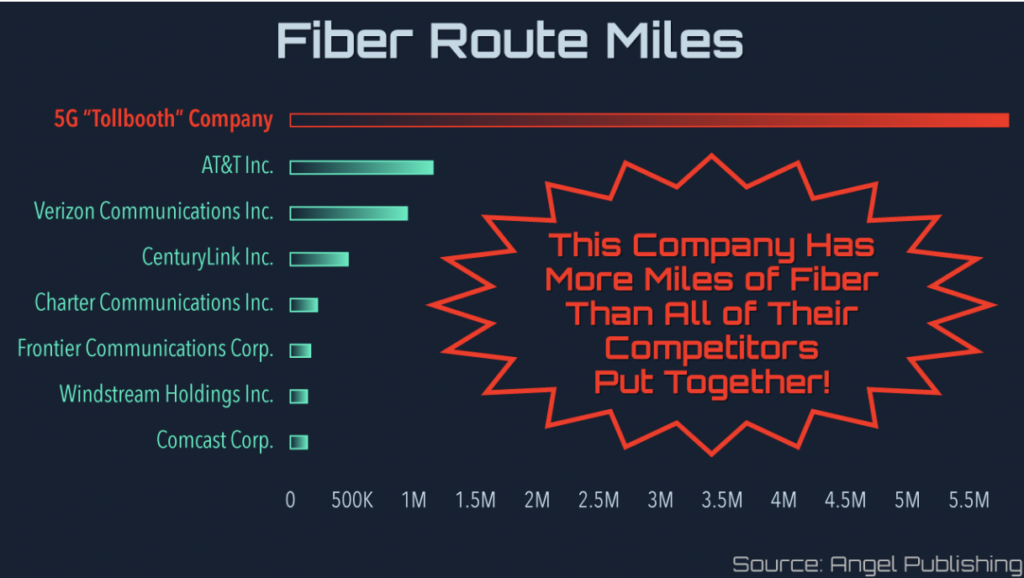

Quite simply: This company owns more fiber networks than anyone else in America.

It is the critical piece for winning the race to deploy 5G.

And best of all, this company’s stock is trading around $10 a share.

But according to my research, you could be sitting on more than 600% profits after all’s said and done.

This company is leading the charge to 5G and could make early investors filthy rich.