300x Better Than NVIDIA?

Sponsored

You've probably read about NVIDIA's recent earnings blowout… Where it revealed that thanks to demand for AI, its future earnings will crush previous expectations. The markets reacted by sending NVIDIA's stock surging by almost 25% in a single day… An impressive feat when you consider it was already a $700+ billion stock before that surge. If you already owned NVIDIA stock before the jump – congratulations… But if you didn't, don't worry… Because I've just discovered an undercover AI stock that I believe could do 300 times better than NVIDIA. I believe this small-cap stock could deliver Huge returns in 2024 – which would be 300 times better than NVIDIA's 25% surge. So just click here to get your hands on my $6 AI Wonder Stock that could make you richer in 2024 (plus a whole lot more)…

Synopsys (NASDAQ:SNPS) is a key player in electronic design automation, essential for designing and testing the integrated circuits at the heart of our tech-driven world. The firm recently soared into headlines, thanks to a nod from Nvidia (NASDAQ:NVDA) at their GPU Technology Conference. Nvidia's CEO, Jensen Huang, highlighted Synopsys’s pivotal role in revolutionizing chip and electronics design, combining Nvidia's AI-driven chips with Synopsys's cutting-edge software.

This alliance isn't just about innovation – it's about redefining speed and efficiency in developing chips and autos. Synopsys is diving headfirst into AI, partnering with Nvidia to harness the power of generative AI and digital twins. Think of digital twins as advanced simulations, shaping the future of design and manufacturing in the tech world.

Recently, Synopsys flexed its strategic muscles by acquiring Ansys, another software titan, for a cool $35 billion, melding cash and SNPS stock in the deal. This move not only expands Synopsys’s capabilities but positions it at the forefront of product design and operations, further cementing its role in the tech ecosystem.

Financially, Synopsys isn’t just cruising; it’s breaking sound barriers. Their top line surged by 21% compared to last year, with operating income rocketing to $359.6 million from $256 million in Q4 of 2022. CEO Sassine Ghazi attributes this climb to increasing investments in AI among their clientele. As for the numbers, SNPS stock carries a forward P/E ratio of 41.67 and a P/S ratio of 14.2, hinting at a robust growth trajectory.

But here's where we, as astute investors, need to keep our eyes peeled. The burgeoning partnership between SNPS and NVDA is key. It's not just about their current synergy; it's about where this alliance can propel them. The impact of this partnership on Synopsys’s top and bottom lines will be a critical metric for assessing its future performance.

In conclusion, Synopsys, with its strategic moves and promising partnership with Nvidia, is more than a blip on the radar – it's a potent combination of innovation, financial strength, and market relevance. As investors seeking to chart a course through the dynamic skies of the stock market, Synopsys demands our attention.Remember, in the world of investing, just like in the cockpit, it's about precision, strategy, and a keen eye for emerging trends. Stay tuned for more insights and guidance from Today’s Top Stocks. Here’s to our journey towards financial success!

Is this tiny $2 stock the next NVDA?

Sponsored

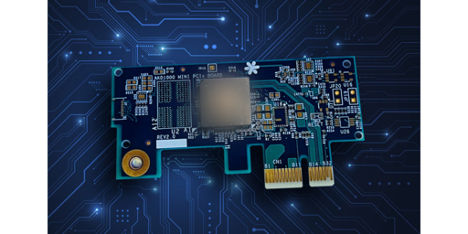

Is this little known chipmaker the next NVDA? It has nothing to do with AI, but this company's patented chip could generate NVDA sized gains in the coming months… This one RIGHT HERE…

How can I say that with such certainty? Because the most powerful tech companies in the world are SCRAMBLING to be the first to market with this new technology… Companies like Microsoft, Intel, and Google are all quietly racing to be at the forefront of this new phenomenon… But unfortunately for them… This one small company holds the key to this revolution… And they already have 12 patents to protect their groundbreaking innovation from copycats… Click here to see why this small company won't be small for long.