300x Better Than NVIDIA?

Sponsored

You've probably read about NVIDIA's recent earnings blowout… Where it revealed that thanks to demand for AI, its future earnings will crush previous expectations. The markets reacted by sending NVIDIA's stock surging by almost 25% in a single day… An impressive feat when you consider it was already a $700+ billion stock before that surge. If you already owned NVIDIA stock before the jump – congratulations… But if you didn't, don't worry… Because I've just discovered an undercover AI stock that I believe could do 300 times better than NVIDIA. I believe this small-cap stock could deliver Huge returns in 2024 – which would be 300 times better than NVIDIA's 25% surge. So just click here to get your hands on my $6 AI Wonder Stock that could make you richer in 2024 (plus a whole lot more)…

Today, I want to share some insights and a crucial recommendation regarding Super Micro Computer (SMCI) stock.

As you know, my investment style is a blend of the strategic discipline I honed over the last 15 years, inspired by icons like Buffett, Dalio, and Miller. This blend guides me in making decisions that are not just about following trends but understanding the underlying dynamics of businesses and markets.

Now, let's dive into SMCI. This company, a key player in tech infrastructure, has been riding the wave of the AI boom, with its stock soaring over 900% in the past year. The surge in AI, propelled by advancements in large language models like ChatGPT, has increased demand for high computing power and storage, benefiting companies like Super Micro Computer.

However, a recent development requires our attention. SMCI announced a new share offering – a move to issue two million additional shares, raising its total to over 58 million. This has caused the stock to drop 12% during morning trading. While they claim the purpose is to gather capital for operations, inventory, and R&D, this dilutes current shareholders' value.

Moreover, the insider activity is a bit troubling. CEO Charles Liang and Director Daniel Fairfax have been selling shares. Although these were part of formal stock sale plans, other sales, like those by Director Sherman Tuan, weren't as clear-cut. And with Director Shiu Leung Chan buying shares only to resign shortly after, it raises eyebrows.

Here's my take: Super Micro Computer is experiencing a classic scenario of a smaller company struggling to maintain its momentum amidst rapid growth. Their recent financial performance is impressive, but this stock dilution and the insider selling signal caution.

As a result, I think investors would be wise to sell Super Micro Computer (SMCI) stock. The current market conditions, combined with the company's strategic decisions and insider activities, suggest that the risks now outweigh the potential rewards. Remember, investing isn't just about riding the waves; it's about knowing when to sail away from a storm.Keep following Today’s Top Stocks for more insights where we utilize our seasoned investing acumen to ensure our strategies stand strong against both time and market turbulence. Until next time, invest smartly and stay ahead of the curve!

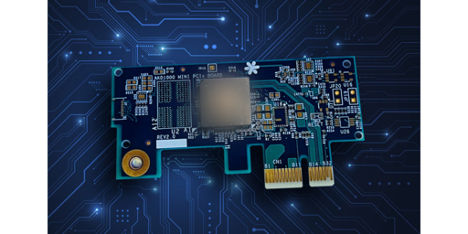

Is this tiny $2 stock the next NVDA?

Sponsored

Is this little known chipmaker the next NVDA? It has nothing to do with AI, but this company's patented chip could generate NVDA sized gains in the coming months… This one RIGHT HERE…

How can I say that with such certainty? Because the most powerful tech companies in the world are SCRAMBLING to be the first to market with this new technology… Companies like Microsoft, Intel, and Google are all quietly racing to be at the forefront of this new phenomenon… But unfortunately for them… This one small company holds the key to this revolution… And they already have 12 patents to protect their groundbreaking innovation from copycats… Click here to see why this small company wonhttps://clicks.itstrackable.com/aff_c?offer_id=726&aff_id=1003&file_id=3417&aff_sub2=webstory't be small for long.