A friend of mine and fellow trader used to do a very funny bit when he gave speeches about his trading strategy.

In full Captain Obvious mode, he’d point to an up-trending stock chart and say “See how this line is moving higher? That’s a goooood thing. It means the shares are going up in value and we’re making money.”

Then he’d put another chart of a collapsing stock on his screen and say ”See how this line on the chart is falling? That’s baaaad. It means the stock is going down and we’re losing money.”

Well, duh. But the simplicity of my friend’s “insight” is the joke.

We all have a tendency to make stock-picking way too complicated.

Buy strength. Sell weakness. Rinse, wash, repeat.

With that in mind – and despite the weakness we’re seeing among Nasdaq technology stocks and cryptocurrencies lately – I continue to like what I see in one part of the stock market.

Oil service stocks remain unloved and out of favor. They’re certainly not glamorous.

But hey, they’re going up – 160% in the past year, and 30% in the past month.

While the stocks in this group may waver around a bit short-term, I think the broad trend remains higher still for this sector.

For much of the past decade, oil companies pulled back on their spending budgets for exploration and production, amid too much competition, climate worries, and the associated decline in oil prices.

Oil peaked at $114 in 2011, and bottomed when prices literally collapsed to below zero for a day or two in last year’s COVID panic.

As we move past the pandemic, oil demand is picking up. But there’s not enough supply – a helpful situation if you’re an oil services company these days.

According to a recent survey by the Federal Reserve Bank of Dallas, economists see a “stark recovery” in spending, with 50% of oil and natural gas companies expected to dramatically increase their capital budgets in 2021.

Likewise, analysts at Barclays Bank expect capital spending to “not only recover by 2023, but upstream spending continues to expand out to 2025 on the back of increasing global demand.”

What about climate change and the ongoing switch to electric vehicles? Turns out that’s also a positive for the oil service sector.

According to the survey, 50% of oil company executives said their companies’ spending plans include carbon dioxide and methane emissions reductions, less flaring (burning of potentially explosive waste gases), and the recycling and reuse of water.

Guess which group of companies they need to hire to carry out those climate-friendly upgrades?

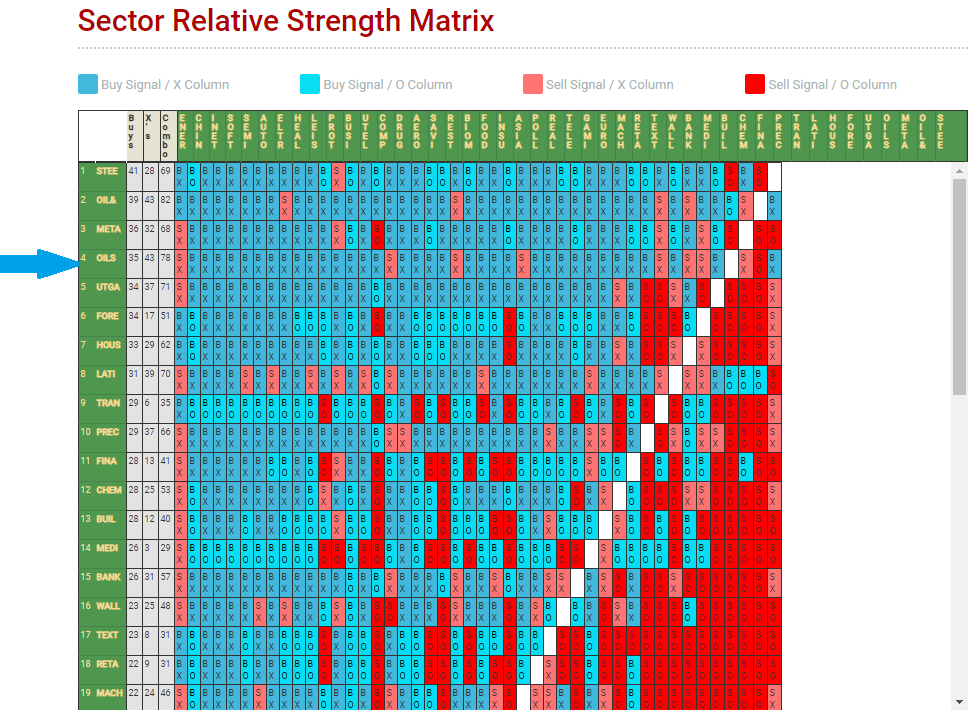

No wonder when we look at the Sector Relative Strength Matrix on Sector Prophets Pro (the premium data program at True Market Insiders), we see that Oil Services is ranked #4 out of the 45 sectors we track.

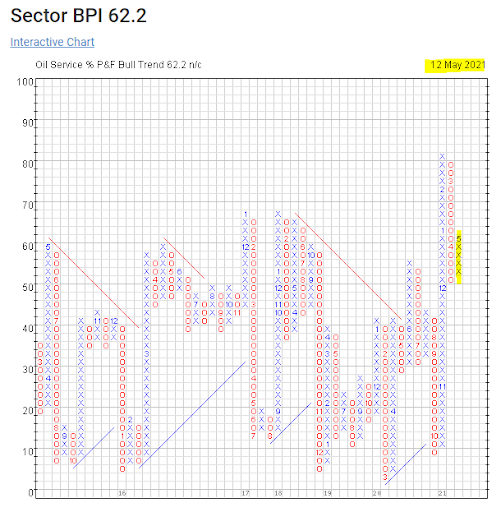

Likewise, the sector is in X’s on it's Bullish Percent Index (BPI) chart and on a point-and-figure Buy signal.

Next up is the sector’s Relative Strength (RS) chart. While pulling back in March, the sector continues to be rated Strong when measured against the Equal Weighted S&P 500.

So there’s a lot to like about this sector and the companies in it.

Among them, one of my favorites is Oceaneering Int’l (OII).

Founded in 1964, this company wrote the book on the highly technical and (in its early days) dangerous work of deep sea hardhat diving for offshore oil platforms.

In the decades since, the company continues to innovate with new kinds of submersible ROVs – remotely operated vehicles – that handle much of the same kind of work at even greater ocean depths.

These days the company operates across a handful of industry-related businesses, from component manufacturing (like fluid and gas control valves), to digital systems, and startup and maintenance services for offshore platforms.

Oceaneering also devotes some of its highly technical expertise to government contracts with NASA and the Department of Defense.

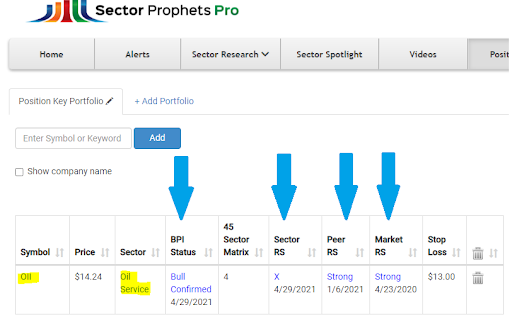

The stock checks all the boxes on the Position Key (another premium research tool that comes with Sector Prophets Pro.

Here’s what those blue arrows mean…

- The oil services sector is on Bull Confirmed status on its BPI chart.

- The sector is strong relative to the market…

- Oceaneering’s stock is strong when compared to other companies’ stocks in its sector…

- The stock itself is strong compared to the market, too.

And no wonder – Oceaneering International has beaten Wall Street’s earnings projections by substantial margins in three of its last four quarters.

So here’s my bet. I think Oceaneering can rise at least another 30%, and hit $20 a share, over the next 3 months.

I expect two powerful catalysts.

One, I think Oceaneering will beat estimates once again when it reports Q2 numbers in late July.

Analysts are expecting the company to generate earnings of $0.06 a share for the period. But given the still-unfinished work of re-opening the global economy, I think it could report profits of $0.10 to $0.12 a share instead.

The second catalyst is oil prices.

The commodity jumped 35% since the start of the year. In that time plenty of traders went from thinking “oil is dead” to “$100 a barrel by June” – especially after the headlines about gasoline shortages following the recent Colonial pipeline cyber attack.

So it wouldn’t surprise me to see oil prices sell off a bit over the next month to correct some of the bullish froth.

But as we approach the summer driving season, and with improving news on the COVID front from places like India and Brazil, I think we’ll see oil resume its uptrend – giving Oceaneering’s stock a big push to hit $20 and its highest levels in the past 2 years.

Right now the large institutions seem to like what they see with OII.

So far this year the big hedge funds have purchased almost 3x as much OII as they’ve sold — $105 million versus $36 million.

Read Next: Most stocks suck. These don't…

Sponsored

Most stocks suck …

But we believe the stocks inside this folder will shine …

This is a confidential list of the only basket of stocks you might ever need to own.

Right now, 5,312 publicly-traded companies offer their stocks to investors.

The problem is nearly all of them are what I call “sucker stocks.”

Maybe 70, at best, are worth your time and attention.

Of those — just the 35 high-profit potential, lower-risk stocks inside this folder — make the grade and are worth owning.

Think I’m kidding?

Then take a look at what an eye-opening study from the Arizona State University School of Business says …

“The entire gain in the U.S. stock market since 1926 is

attributable to the best-performing four percent of listed stocks.”

In other words, 96% of stocks aren’t worth the paper they’re written on. Chances are quite a few of the stocks in your portfolio are in that group.

They’re virtually worthless and draining your returns.

The 35 stocks on this list, on the other hand, are in that 4% of stocks driving the market. They’re the ones you need to own.

That’s why I’ve made special arrangements to get this document into your hands today.

So you can find out what these 35 stocks are — absolutely free — and buy as many shares as you want.