This article was originally posted here

Using dividend-paying stocks as the backbone of a diversified portfolio is a wonderful thing. However, those new to investing might have some questions about dividends. But knowing what a dividend is and how dividends work is only half the battle, since knowing how to make the best use of dividends can set you on the path to true financial freedom. Here's a dividend investing guide that will provide you with a basic understanding of what dividends are and help you create your own dividend portfolio strategy.

What is a dividend?

A stock investment is, at its core, a claim on the long-term stream of cash flows generated by a business, or the money generated by the business. There are different ways to benefit from these cash flows, with the two main sources being an increase in stock prices due to growth in the business, referred to as capital appreciation, and cash distributions funded by the ongoing cash flows the business generates. Dividends are a form of cash distribution and represent a tangible return that you can then use for other purposes.

A dividend-paying company is, essentially, writing a check to its shareholders out of the profits it generates. For investors who use a broker, which is most investors, that check will simply be a deposit that shows up on your brokerage statement. Dividends are generally paid to shareholders at regular intervals, with quarterly being the most frequent timing in the United States. However, dividends can also be paid monthly, semiannually, annually, and even on a one-off basis, in the case of “special” dividends. (There's more information on the frequency topic below.)

To help with the processing of dividends, there are a few key dates to watch, most notably the ex-dividend date, which is the first trading day on which a future dividend payment isn't included in a stock's price. After the ex-dividend date, a stock trades as if it has already paid the dividend. If you buy the stock before that date, you get the dividend. If you buy the stock after the ex-dividend date, you don't receive the dividend.

This all may sound a little complicated right now, but after spending a little time understanding dividends, you'll see that they're pretty easy to get your head around. Despite their simplicity, however, they can have a huge impact on your financial life. A real-world example will probably help here. ExxonMobil Corporation (NYSE:XOM) pays quarterly dividends in March, June, September, and December. Between January 1 of 2009 and December 31 of 2018, the company's stock fell roughly 15%. But investors who took those quarterly dividends and bought more Exxon stock (known as reinvesting) would have achieved a gain over the 10-year span of 15%. This is because they were buying stock all along, increasing their investment with the dividends they received.

Are dividends a good thing?

For some investors, dividends are great…for others, dividends are a nuisance. In the end, whether you think dividends are good or bad will really depend on your investment approach and temperament. For example, some investors use their dividends to supplement their Social Security check during retirement. Such investors love dividends. Other investors, those who wish to avoid taxes or who are still building a nest egg, might prefer to see a company reinvest all of its cash into the business to spur higher levels of growth. Investors like that might deem dividends a waste of cash.

Some investors might also prefer to see cash used to buy back stock instead of pay dividends. Buying back stock is another way in which companies can return cash to shareholders without actually distributing the money to shareholders. The ownership interest in a company is spread across the total number of shares a company issues. By reducing the number of shares outstanding via a buyback, the company gets to spread earnings over a smaller share base. So every share is awarded a larger piece of the company's earnings, which, in turn, increases earnings-per-share growth. Since earnings are a key metric by which company success is graded by investors, higher earnings generally lead to higher share prices.

Some companies like to use share buybacks because they don't actually have to complete buybacks even if they announce them. This provides more flexibility in case the business environment changes. Investors tend to react poorly if dividend payments are reduced even if a company is facing hard times.

How are dividends decided?

At the most basic level, the chief executive officer of a company makes a recommendation to the board of directors on what he or she believes is an appropriate dividend policy. Often there is no specific public policy to go off of, just the dividend history. But some companies do make public their dividend goals. For example, some companies target a percentage of earnings or cash flow. Brookfield Renewable Partners, for example, targets 70% of distributable cash flow, a non-GAAP measure that shows how much cash it could pay if it wanted to. That said, the intent is to keep growing the dividend along with the partnership's growth, so it will hover around that target over time. You should check to see if a company has a stated policy, but often you'll be stuck with nothing more than the history.

It's important to note that the CEO isn't the one making the final call here; the board of directors is. This collection of individuals comprises the elected representatives of the shareholders. They are effectively the boss of the CEO and have the final say on key issues, including how a company's profits should be used. Dividends are a big piece of that story. So the board takes the CEO's advice, discusses it, and votes on what it believes the dividend should be. The types of issues a board might look at include, but are not limited to, the company's profitability, available cash, leverage, and future capital needs.

A key issue to keep in mind here is that while a company's earnings are an important consideration in this process, dividends actually come out of cash flow. Earnings are an accounting measure dictated by a standard set of rules that try to tie revenues and earnings to specific time periods. Cash going in and out of the company, or cash flow, doesn't work the same way. For example, a big capital investment like a truck will be paid for when it is bought, reducing the cash a company has the day it is acquired. But for earnings purposes, the cost will get spread across the useful life of the truck, since it is getting used a little bit each quarter. This is called depreciation, and it has no impact on cash flow, but it can be a notable issue for earnings.

Since dividends are paid out of and impact a company's cash, with little to no impact on earnings, the cash flow statement is where dividend payments are reflected. This statement actually tracks the cash that is going in and out of the company during a set period of time. Going back to the truck example above, a company's earnings may be lowered by depreciation expenses for that expense for years, but the cash going in and out of the company won't be impacted because the money was already spent. So the cash a company has available may actually be more in a given period than the earnings a company reports. This helps explain how a company can pay more in dividends than it earns, since noncash charges, like depreciation, can lower earnings while having little to no impact on the cash a business is generating.

At the end of the day, the cash flow statement is closer to how you might look at your own finances. While the earnings statement is important, the cash flow statement is the best way to see if a company can actually afford the dividend it is paying.

Some key dividend dates

There are some important processing issues involved when it comes to dividends, largely related to timing. The first is the declaration date, which is when a company announces its dividend plans to the market. In this statement, in addition to the actual dividend amount, it will report the record date, the ex-date, and the payment date. To understand this process, it may help to look at a real-life example.

On October 31, 2018, ExxonMobil put out a news release informing investors and the public about its intention to pay a fourth-quarter dividend of $0.82 per share. That news release was the declaration of the dividend. In addition to the amount, the company also reported that the dividend would be paid on December 10 to shareholders of record as of November 13. The payment date is the day on which shareholders will receive the dividend. The record date is effectively the day the company makes the list of all of its shareholders.

The only date that wasn't included in the release was the ex-dividend date, which is generally two business days prior to the record date to account for the time needed to clear stock transactions. (In this case, the ex-dividend date was November 9 because of a weekend.) This date was not in the press release but was reported on the company's website. Purchase the stock prior to that date and you will be eligible for the dividend; buy after the record date and the previous owner will get the dividend. In effect, the ex-date is the specific date on which the stock will trade without the dividend included in the price.

For most investors, particularly those with a long-term view, these dates will not be too big an issue. However, if you are looking to buy a stock, you might want to double-check the dates just in case. You'd rather get a dividend than miss it by a day or two because you procrastinated.

Some investors, meanwhile, try to capture dividends by investing around these dates. Dividend capturing is a strategy in which investors only hold stocks long enough to receive the disbursement before moving on to another stock. In this way, the investor can invest in many dividend stocks with the same money and “capture” more dividends. Although this sounds like a great idea, it is complicated and time consuming.

There's another technicality that complicates the dividend capture approach: Dividends are technically a return of retained earnings (a balance sheet item). As such, the stock price logically should fall by the amount of the dividend once it hits the ex-dividend date. There's also the risk that the stock price could be moved by company news or events in the broader market during the holding period. So you will generate income from the dividend you collect, but you could end up with an offsetting capital loss when you sell the shares. It's very possible that the net benefit will be less than you might hope, and thus, most investors shouldn't get involved with dividend capturing.

Some key dividend metrics

Now that you've got the important dates to keep in mind, you'll want to understand some of the key metrics you'll see when researching dividend stocks. The most prominent is the dividend yield. This is generated by taking the most recent dividend payment and multiplying it by the dividend frequency (how many times a year the dividend is paid) and then dividing by the current stock price.

The higher the yield the better for most income investors, but only up to a point. Abnormally high yields can indicate heightened levels of risk. A good reference point for investors is to compare a stock's yield to that of the S&P 500 Index to get a sense of whether it is high or low, since market conditions can change over time. Yields should also be compared to those of direct peers to get a sense of how high or low a yield is, since some industries tend to offer higher yields than others. Note that some data services will provide a trailing dividend yield, which takes historical dividends that were paid (usually over the last 12 months) instead of looking at the current dividend and multiplying by the frequency.

Another metric that investors focus on is the payout ratio. This can be derived by taking the dividend and dividing by the company's earnings per share. Although dividends don't get paid out of earnings, this gives an idea of how easily a company can afford its dividend. The lower the payout ratio the better, with ratios over 100% worthy of additional research (noting that some industries, such as real estate investment trusts, almost always have payout ratios over 100% because of heavy depreciation expenses). This figure can be calculated over different time periods, but it is usually looked at quarterly, over the trailing 12 months, or annually.

Some investors will also look at yield on purchase price. You calculate yield on purchase price by taking the current dividend per share and dividing it by your average cost per share. This is a number that is, obviously, specific to each individual investor. It is most appropriate for investors who have owned a dividend-paying stock for a very long time and for those who have used dollar-cost averaging to create their position. For example, if you had purchased Microsoft Corporation on the first business day of 1995 for $26.95 (the highest price on that day), the dividend was a scant $0.32 per share per year, providing investors with a roughly 1.2% dividend yield. By the end of 2018, the dividend had grown to $1.68 per share per year. That's a yield on purchase price of 6.2%!

How often are dividends paid?

Dividend yield and the payout ratio bring an element of time into the dividend discussion. In the United States, most companies pay four dividends a year, or one each quarter. That, however, is just one option. Some companies, like Realty Income, a real estate investment trust, pay dividends monthly. (There aren't too many monthly dividend stocks, which is a shame, since the dividend checks from these companies end up closely mimicking a regular paycheck, thus simplifying the budgeting process for investors.) Others pay twice a year, or semiannually. An example here would be Disney, which pays in January and July. Many European companies, meanwhile, only pay two times a year, with one small interim payment followed by a larger “final” payment. Most U.S. companies pay the same amount each time. Some companies only pay one time a year, such as Cintas, which tends to wait until near calendar year-end to pay its annual dividend.

To properly figure out the dividend yield and payout ratios of these companies, you need to take the dividend frequency into consideration. Note that some data services don't get this step right, leading to erroneous data. So you should always go to a company's website to double-check any dividend statistic that seems unusual.

There's one more thing to keep in mind here as well. Sometimes companies pay special dividends. These are payments that are made outside of their typical dividend schedule. An example is Kinder Morgan Canada, which sold a large asset in 2018 and chose to distribute a portion of the cash it generated to shareholders via a one-time distribution. Such dividends shouldn't be considered in the yield or payout ratio, since they are unusual events. That said, some companies have a history of paying special dividends on a regular basis, like L Brands, though it hasn't done so lately, showing that such extra payments shouldn't be relied on.

Not all dividends are paid in cash

To complicate things even more, dividends aren't always paid in cash. Sometimes a company pays a stock dividend, through which it issues each investor additional shares of the company. One great example is Tootsie Roll Industries, which has a very small cash dividend but also generally pays out a small stock dividend each year. The net benefit for investors is that the number of shares they own increases over time.

Other times, a spin-off is effected via a stock dividend in a new company. This happens when a company gives shareholders freshly created shares in one of its operating divisions so that it can break the division off as its own public company. One of the classic examples of this was the 1984 breakup of AT&T, lovingly referred to as Ma Bell, into a long-distance company of the same name and seven so-called Baby Bells. The Baby Bells owned the local telephone companies serving various regions of the United States. For every 10 shares of AT&T, investors received one share in each of the seven regional phone companies. This move broke AT&T from one company into eight.

All of that said, stock dividends are generally not the norm, though a small number of companies do have long histories of paying regular stock dividends.

What's a dividend cut?

So far so good, but dividends don't always go up. Sometimes when a company is facing financial trouble, it has to cut its dividend. Investors usually don't like dividend cuts, as noted above, and will sell companies that cut or that they believe are likely to cut. This is why you need to use caution when looking at companies with high yields and high payout ratios, as both could be a sign that the current dividend isn't sustainable.

That said, some companies have variable dividends, so their dividends are expected to go up and down over time. Dividend changes at companies like this have to be looked at differently because the dividend policy is often more important than the dividend payment. Wheaton Precious Metals is a good example here. The company targets 30% of the average cash generated by operating activities over the previous four quarters. And it pays out exactly that amount, regardless of whether it is more or less than the previous dividend. This is noteworthy because Wheaton generates revenue by selling precious metals, the prices of which can be volatile.

What is a DRIP?

An acronym you'll frequently hear associated with dividends is DRIP, which stands for dividend reinvestment plan. Many companies allow you to buy stock from them directly and then use the dividends to automatically buy additional shares over time. Sometimes companies offer incentives for this, such as slightly-below-market reinvestment prices, and usually these transactions will not incur brokerage trading fees. A few companies require that you buy stock from a third party and then transfer the shares to the company's plan. The big deal here, however, is that you are using the dividend to buy more shares. That's basically dollar-cost averaging, or spreading your purchases over time.

This is a service that many brokerages offer for free today (without the incentive of below-market prices). So you can often do the same thing without the need to open and monitor multiple accounts with different companies, which is what you would be left with if you enrolled in multiple company-sponsored DRIP plans. If you like to keep your life as simple as possible, ask your broker if it offers free dividend reinvestment.

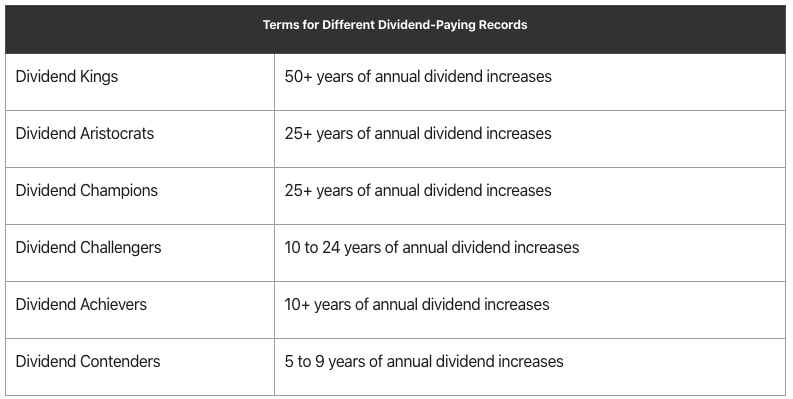

What are Dividend Kings, Aristocrats, Champions, Challengers, and Contenders?

Dividend investing is a big thing, and investors have taken to using shorthand terms to describe dividend companies. Kings, Aristocrats, Champions, Challengers, and Contenders are some of the “in the know” terms you'll want to be fluent with. Each represents a different streak of annual dividend hikes:

All of these terms are associated with longtime dividend payers. Some are formal lists that are maintained by companies like Standard & Poor's (and used to create investment products like exchange-traded funds, or ETFs ), while others are informal lists maintained by volunteers and available for free at websites like The DRiP Investing Resource Center.

Lists such as these are a great starting point when looking for dividend stocks, since companies with a long history of increasing dividends have proven that they place a high value on rewarding investors.

What is a dividend trap?

A dividend trap is yet another term you'll hear to describe a dividend stock, only this one isn't positive at all. Essentially, a dividend trap is a stock with a high yield backed by a dividend that looks unsustainable. A good example here is rural telecom Frontier Communications (NASDAQ:FTR). In 2017, the company paid four quarterly dividends of $0.60 per share despite the fact that it was bleeding red ink the entire time. With no earnings, its dividend coverage ratio was actually negative. Its business had been struggling for some time under the weight of deteriorating financial results and a heavy debt load left behind from acquisitions.

The company ended up eliminating the dividend in 2018. However, as 2017 progressed, the dividend yield went from around 10% or so to an unbelievable 50% as the stock plummeted from more than $50 per share to roughly $6.75. A yield of 10% is high and deserves extra attention, particularly at a highly leveraged money-losing company. But a yield of 50% is completely ridiculous — the stock market was sending a very loud warning signal. Before you jump on a fat dividend yield, make sure you do a little digging to ensure that the high yield isn't a result of material financial troubles and, equally important, a high likelihood of a dividend cut. You want to do your best to avoid dividend traps like Frontier.

Do dividends tell you anything about valuation?

Often investors look at a price-to-earnings ratio to see if a stock is trading cheaply or richly. P/E is just price divided by earnings, much like a dividend yield is simply dividend payment divided by stock price. They are both relative measures. P/E tells you how much investors are willing to pay for each dollar a company earns, and dividend yield, roughly, tells you the level of income generation investors expect from a company over time.

Truth be told, on their own, P/E and dividend yield don't tell you all that much about valuation. However, when you compare them to a company's own history or to a broader group (like an index or direct industry peers), you can start to see valuation patterns. For example, Hormel Foods‘ dividend spiked above 2% in late 2017, toward the high end of the company's historical yield range. Its P/E at the time was around 19, having fallen from more than 30 in early 2016. Essentially, the dividend yield was telling a similar story to the P/E ratio.

There are usually reasons why companies trade with low valuations; in this case, a shift in consumer buying habits toward fresh food over the prepackaged fare that dominated Hormel's portfolio had spooked Wall Street. But for long-term investors, a high relative dividend yield can be a buying opportunity. Hormel, for reference, started to shift its business mix via acquisitions that augmented its scale in fresh categories, notably including the deli aisle. By the end of 2018, Hormel's yield was roughly 1.8% and the P/E was back up to around 22.

Dividend taxes: Uncle Sam gets his due

No discussion of dividends would be complete without mentioning taxes. The government wants to get its due of these payments. You will receive tax forms from your broker or DRIP plan that outline what dividends you have received in a given year, and that information must be included in your income when you do taxes.

That said, tax laws change over time, so the tax rate you'll pay on dividend income will vary. Dividends often receive preferential tax treatment. All dividends, meanwhile, are not created equal. Some companies include return of capital in their dividends. Such dividends are considered a return of a portion of your original investment and don't get taxed when you receive them. They reduce your cost basis when you sell, thus increasing your capital gains (which is the difference between what you paid for an investment and what you sold it for, assuming you made a profit on the transaction).

Other companies, notably real estate investment trusts, are structured as pass-through entities because they pass much of their income to investors in exchange for avoiding corporate-level taxation. Most if not all of the dividends they pay are treated as regular income — just like your salary. These types of dividends are often referred to as unqualified.

Qualified dividends, meanwhile, are the norm. This type of dividend is paid by most U.S. companies and gets taxed at special rates. As an example, in 2018, qualified dividends paid to a couple filing jointly with earnings less than $77,200 a year don't get taxed at all. Such a couple making less than $479,000 but more than $77,200 would see their dividends taxed at a 15% rate. And a couple making more than $479,000 a year would see a dividend tax rate of 20%.

Taxes are a complex topic, and you should consult an accountant for an in-depth discussion here. But rest assured that you need to let Uncle Sam know about your dividends, or the IRS will be sure to hunt you down and extract its pound of flesh.

That said, there's a workaround on the tax front if you really don't want to pay taxes on your dividends: a Roth IRA. Like taxes, retirement accounts are complex, and a full discussion is beyond the scope of this article. But a Roth IRA is funded with money on which you have already paid taxes, and distributions in retirement are tax-free. So if you put dividend stocks into a Roth IRA, you would, effectively, be generating tax-free income. This is not the case for a traditional IRA, which is funded with pre-tax earnings…in this case, every penny you pull out is taxed as income. If the idea of using a Roth IRA to generate tax-free income sounds enticing, it's probably worth taking the time to talk to your accountant.

8 Top Dividend Stocks for 2020

Now that you know the basics, here are a few dividend stock ideas from one of our analysts to get you started.

- AT&T (NYSE:T)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP)

- CareTrust REIT (NASDAQ:CTRE)

- Ford (NYSE:F)

- General Motors (NYSE:GM)

- ONEOK (NYSE:OKE)

- TerraForm Power (NASDAQ:TERP)

- Verizon (NYSE:VZ)

Bonus: One little-known dividend…

Get Paid Every Time Amazon Ships A Package

This shocking news could make you $48,000 richer…

After 24 years of steady growth, Amazon has been accused of being anticompetitive.

And it's been quietly slapped with a “tax” that's worth more than $938.2 million every single year.

Now, thanks to U.S. law, you can claim your slice of this jackpot and collect up to $48,000 over the next year.

All you'll need to do is follow the steps in this presentation.

I urge you to act quickly.

P.S. In the time that it’s taken you to read this email, Amazon has shipped 2,083 packages. Imagine if you could get paid every time a package left the warehouse floor… You can. Click here to enroll for your $48,000 payout.